This is part two of The Infinite Banking Concept Review, the first article was: What You Should Know About The Infinite Banking Concept

The reason for overfunding a life insurance policy is to build up the cash value inside the policy as quickly as possible. The principle is the same as for any financial product. The more money you put on a compound growth curve in the shortest period of time, the more cash you’ll accumulate as long as all other factors are equal.

Side note: This is where I’m going to get into a lot of trouble with my fellow life insurance advisors, and I’ve already taken a lot of heat for it. While I do think using a custom whole life policy with paid-up additions produces the best results, it’s also not necessarily the simplest way to pull this off. When I originally wrote this piece, I neglected to emphasize this point. I want to do that now.

If you can’t find a knowledgeable, reputable, agent to help you out with this (and I cannot stress this point enough — the agent has to be very experienced in policy design), your second-best option is to use a 10-pay whole life policy.

That product will be guaranteed paid in full after 10 years. It builds cash value very quickly and you don’t have to worry about hitting that MEC guideline. There is a caveat here, and one that others have tried to call me out on, saying in essence: “If you listen to this guy… you’re limiting yourself as to how much money you can put into your policy. 10-pay life insurance doesn’t allow payments beyond 10 years and you can’t repay the policy loan with too much interest or it will MEC the policy.”

All true statements, but all of them irrelevant. Look, I have not always been a great communicator, and I’ve made many mistakes in the past (like not properly emphasizing or clarifying a point I’m making), but I’m sticking to my guns on this one: if you don’t have an agent you can trust, do yourself a favor and use a simple product like the 10-pay policy. If you do have an agent you can trust, and he or she can prove they know what they’re doing, by all means use them and get yourself a custom policy. You’ll be happy with it, I promise. I’ll address the alleged downsides of using a 10-pay in a moment.

But first…

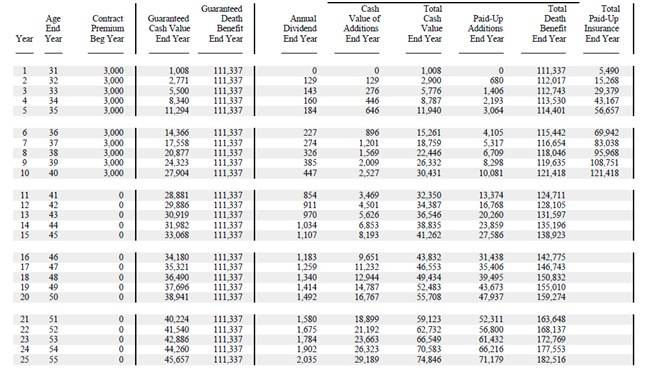

Look at the illustration of a 10-pay policy below:

http://setupselfdirectedira.com/nuwireinvestor/wp-content/uploads/2011/12/InfiniteBankingExample1.jpg

Your policy is paid up in full after 10 years with a 10-pay policy, and you don’t owe any more premiums. However, you don’t have to wait out the 10 years to start borrowing against it.

Look:

http://setupselfdirectedira.com/nuwireinvestor/wp-content/uploads/2011/12/InfiniteBankingExample2.jpg

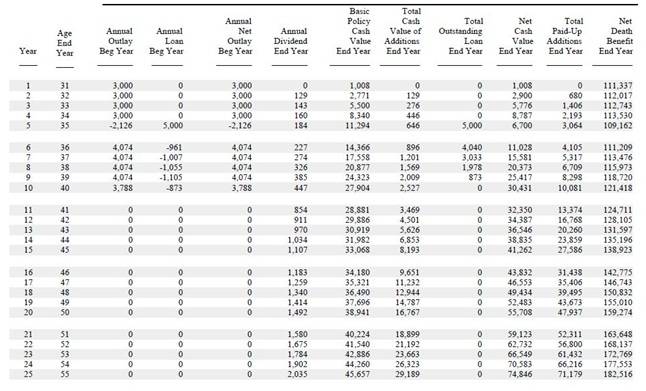

Let’s say you wanted to take out a loan in year 5 for $5,000. The 4th column from the left titled “annual loan Beg Year” shows you the loan amount you take in year 5. This figure is also duplicated 5 columns over under the column title “total outstanding loan end year.” The difference between the two columns is that one shows you the loan balance at the beginning of the year, while the other shows you the loan balance at the end of that year.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

If you begin repaying the loan amount with a $100 per month suggested loan repayment, your loan can easily be repaid over the course of 5 years. The insurance company is charging 5% APR in this illustration. But, you can repay more than that (and it’s usually a good idea to do so for reasons which are outside the scope of this article). This $100/month loan repayment represents about a 7.5% interest rate on the loan. This would be like taking out a small loan for a used car with an APR of 7.5%.

Why do this?

One of the arguments against this concept is: “It’s stupid to pay interest on your own money.”

Well, no, it isn’t actually. Time has a value. This is why the banking industry exists. It has figured out what time is worth, expressed as an interest rate. Also, it’s really difficult not to pay interest on your own savings. For example, if you put $5,000 in your checking account and then go take out a loan for $5,000 (credit card, personal loan, mortgage, etc.)… you’re effectively paying interest on your own savings. The difference with the “Infinite Banking Concept” is you direct those interest payments to yourself instead of the credit card company.

Now… look at the restored cash value amount in year 10. When your loan balance is $0, this means that you’ve repaid the loan in full. In year 10, the “total outstanding loan end year” reads $0. The column just to the right of that, which reads “net cash value end of year” reads $30,431. Now, scroll up to the original illustration. There’s no loan being illustrated here, so you must look at the 8th column in from the left, titled “total cash value end year.” At year 10, you’ll see the cash value amount is $30,431.

Wait a minute. The cash value is the same for both policies.

This means the policy grew as though you had never taken out a loan at all. And it’s because money never came from the policy. It came from the insurer. Also, the insurer continued to pay the same dividend scale with the loan out against the policy. This is the effect of non-direct recognition. Again, not magic, but nice to know.

Many years ago, I used to oversimplify things by saying that the interest rate on the policy loan didn’t matter because it would all come back to you anyway. That was a mistake and one I’ve taken a lot of flack for. It’s not that it’s wholly untrue. It’s that I could have been more accurate in how I explained it.

Here’s what I mean: insurance policy loans are a very inexpensive way to finance things (most of the time). If you pay the insurer $1 in interest, and your dividend that year is $1, you’ve effectively recovered your interest cost. That doesn’t always happen, but it can.

Now, if you pay $1 in interest to the insurer, and your dividend is $0.50 the next year and $0.50 the year after that, you still recovered your interest cost but it took longer.

Is it possible to get a cheaper loan through a bank than though an insurer? Sometimes. Should you do it? Maybe. A lot of it depends on what you give up by going to a bank and whether you’re really getting a better deal. Some insurance agents argue it’s all about the interest rate you’re paying. They’ll tell you if you can get a lower interest rate elsewhere, do it. The problem with that thinking is it’s not always obvious which is the better deal by comparing interest rates.

This is especially true when it comes to financing things like vehicles, where interest cost can be capitalized (which “hides” the real interest rate you pay by financing through a conventional lender). There are ways to get around this using an insurance policy loan as opposed to dealer financing or a bank loan. By using an insurance policy loan, and some clever negotiation, the end result is you usually end up paying less interest, even if the policy loan rate is higher than an advertised APR through a car dealer.

Keep in mind what I’m illustrating here is one loan. You can keep recycling the money in that policy over and over for anything your little heart desires and the same phenomenon will occur. Most of the time, you can’t do that with a conventional bank. You have to requalify for another loan.

With an insurance policy, you can take on multiple loans at the same time from your policy as long as there is cash value available for borrowing and the insurer cannot deny you the loan. Amazing.

At this point, I want to address the issue of the policy becoming a modified endowment contract (MEC) because I’ve been beaten up over this a lot by other insurance agents lamenting the use of an uncomplicated approach to IBC. If you’re going to use a 10-pay policy, make sure you have plenty of convertible term insurance waiting in the background. Convertible term allows you to convert your term insurance to whole life. Why is this important? Precisely because you can only put so much premium into a 10-pay life insurance policy.

When your policy cannot accommodate any more premium, you’ll want to convert some term insurance to another whole life policy so you can keep your cool little system going. And, with convertible term, you don’t have to worry about health issues in the future limiting your ability to buy more insurance. The insurer must convert your policy to whole life, guaranteed.

And guess what? The Infinite Banking die-hards will tell you when your custom whole life policy cannot accept anymore premium, they’ll start another new policy for you… so they’re doing something similar… the difference being they’re using a custom policy design. And here’s where I have a bone to pick with them.

See, there’s a much more efficient way to use convertible term than starting a new policy and it will dramatically improve cash value growth. I’ve seen some advisors recommend people have something like 20 different policies. That’s OK, but it can be a lot to keep track of and each new policy comes with new costs and a new “breaking in” period where cash value lags the premium payments. Using a custom insurance plan, fewer policies are needed and you end up with more cash value. And, that’s why I say a completely custom and comprehensive life insurance plan produces a better result.

However, if you don’t know (or don’t trust) anyone in the insurance business, this is the second-best way to go.

Either way, there really isn’t another financial product capable of pulling this off, which is why life insurance is the favored financial product for this concept.

Message from the Author

This article was updated on Nov 30th, 2016. A lot of insurance agents and the general public have contacted me about what I originally wrote back in 2010-2011. It generated a lot of controversy. To be fair, I could have been more clear on a few points. But, there has been such a distortion of the facts I presented, I decided to update this piece for clarification.

Author Bio

David Lewis is the founder of Monegenix®, a company specializing in an educational approach to insurance-based financial planning. David also designs custom life insurance and cash flow plans for small business owners and professionals. For more information, go to www.monegenix.com.