We’ve all heard of rare autographs penned by history’s biggest names being sold for staggering amounts at auction, leading to healthy returns for their sellers. This can lead to the misconception that autographs are an ‘easy win’ investment.

As a professional autograph dealer, I can confirm that certain autographs have the potential to be very beneficial investment opportunities. However, there are a number of factors that influence the value of a signature.

In this post, I use my expertise in the industry to help clarify what makes an autograph a good investment, but also share some of the common dangers to look out for.

Why are autographs a good investment?

There’s no denying that autographs do have the potential to be a sound financial investment. With signatures from infamous names each holding their own unique story, it’s no wonder that so many are deemed ‘priceless’. However, it’s important to note that the huge sums of money made on signatures in auctions that make the news are as rare as the autographs themselves.

While it is possible to get lucky with an autograph which rapidly gains value, often due to events such as the death of its writer, most successful investments are the result of careful research and a good eye for an investment-grade autograph.

The key to purchasing an autograph for financial investment is to find one which meets the following criteria:

- Name – is the autograph penned by a well-known historical figure?

- Quality – is the signature itself of high quality?

- Era – is it from a notable period in time?

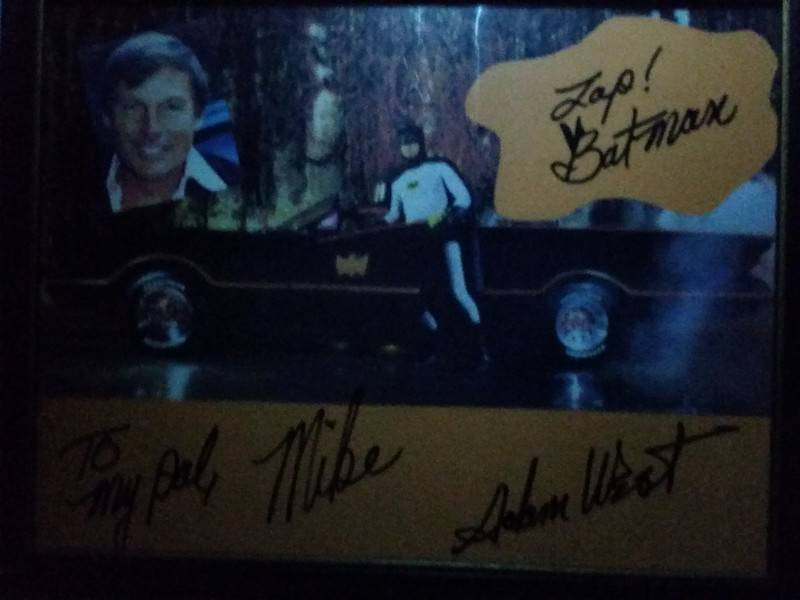

- Provenance – does the signature hold a unique story?

If an autograph can tick any—or all—of these boxes, then it is likely to be of greater monetary value.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

The risks involved with autograph investments

Because autographs can hold considerable value, there are certain risks that need to be considered when making an investment, including:

- Protecting your purchase against damage or loss

- Forecasting the future value of your item

- Avoiding counterfeits

- Paying the correct price for your item

Many of these risks can be reduced with the right measures in place. For example, it is possible to take out insurance policies for autographis which protect you against loss or damage. You can also research trends in autograph sales to predict which are likely to prove the safest investments.

Counterfeiting is unfortunately common in the autograph industry. With huge monetary value connected to rare signatures, there are instances of foul play which are invisible to the untrained eye.

How to find investment-grade autographs

However, these risks should not discourage investors. The positives undoubtedly outweigh the negatives, and there are some simple steps you can take to find autographs which are of investment quality.

Always buy from a reputable dealer

If you want to purchase a potentially high-value autograph as an investment, it’s important that you source it from an industry expert you can trust.

A certified dealer will be a reliable source of information and have the skills to identify and value authentic autographs, ensuring you pay only what a piece is worth.

Look for provenance

A standalone signature can be valuable, but something with a story will always be worth more.

Finding an autograph with provenance can not only increase the monetary value of the item, but make it more unique and truly one-of-a-kind.

Get it authenticated

If you are looking to buy an autograph privately, rather than from a dealer, it’s vital that you have the item authenticated by a specialist before transferring funds. You should never buy an autograph without a certificate of authenticity.

A specialist will analyze everything from the ink used to the paper the autograph is on to determine its authenticity. With years of experience in autograph dealership, a professional will be able to verify even the most unusual of documents.

Conclusion

Like all investment opportunities, autographs come with their risks. However, with the help of a professional, these can easily be avoided and any concerns can be overcome. If you’re looking to invest in autographs, you’re opening the door to one of the most interesting and enjoyable investment forms there is.