Self Directed IRAs

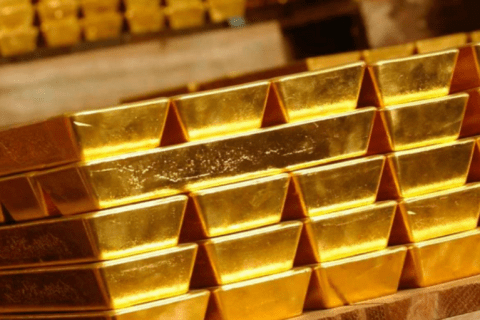

- Alternative Investment 2 Attractive Reasons to Invest into a Gold IRA Company Today

By NuWire December 15, 2021

3 3963 - Alternative Investment Is Gold A Good IRA Investment? Here’s What The Experts Don’t Say

By NuWire July 11, 2021

0 1842 - Personal Finance The Most Important Steps To Take When You’re Preparing To Retire

By NuWire July 1, 2021

0 576 - Alternative Investment Is It A Good Idea To Invest In A Gold IRA? 4 Things You Should Know About It

By NuWire September 23, 2020

0 2322

advertisement

Get Up to $26K

Per Employee

Does Your U.S. Small Biz Quality?

Don't Wait. Program Expires Soon.

Click Here