BitPay Review: Pros, Cons, and More

BitPay

- User-friendly mobile app available on the Apple App Store and Google Play Store

- Users can spend cryptocurrency with over 250 vendors

- Access to BitPay native cryptocurrency exchange

Pros:

- Transaction costs as low as 1%

- Efficient customer support channels

- Intuitive user experience

Cons:

- Substandard security features

- No cashback or rewards system

- Only 16 tokens supported

BitPay Ratings and Reviews

BitPay is a crypto payment solution that allows users to buy, store, and spend their digital assets effortlessly. With an intuitive mobile app, secure crypto wallet, and familiar debit card experience, users of all levels can learn to integrate cryptocurrency into daily transactions.

BitPay Homepage (Source: https://bitpay.com/)

BitPay Homepage (Source: https://bitpay.com/) Highlights of BitPay

- BitPay offers a user-friendly mobile app available on the Apple App Store and Google Play Store with an average user rating of 4 out of 5.

- Users can expect low fees and signup costs, with transaction costs as low as 1% and initial card costs of $10 USD.

- BitPay has displayed power and reliability since 2011 by consistently improving its product offerings.

- Users can spend cryptocurrency online and in-person with over 250 supported vendors.

- BitPay provides efficient customer support channels through accessible AI live chat and an extensive help center.

Downsides of BitPay

- BitPay provides substandard security infrastructure for the platform, with much of the responsibility laying on the customer to safely manage their wallet and card information.

- BitPay does not provide a cashback or rewards system for their cards, however, select vendors may provide rewards for using BitPay.

- BitPay currently offers a limited selection of 16 cryptocurrencies, but they continue to add to their offerings.

BitPay Features

BitPay Exchange: Users can purchase 16 cryptocurrencies directly through the BitPay mobile app, including popular tokens and stablecoins such as Bitcoin (BTC) and USD Coin (USDC). Users can also directly swap supported token pairs.

BitPay Card: The flagship BitPay Card is a prepaid crypto debit card that allows users to easily spend cryptocurrency at supported vendors. Funded through the BitPay Wallet, users can even earn cashback rewards from select vendors.

BitPay Wallet: Customers can effortlessly track and manage their cryptocurrency through the BitPay mobile wallet. With layers of security, users can safely fund their BitPay cards, send crypto, or simply store their digital assets.

BitPay Spend: BitPay allows users to spend crypto at hundreds of supported vendors online and in person. Users can shop online through the mobile app, the browser extension, or the BitPay Card directly at the store.

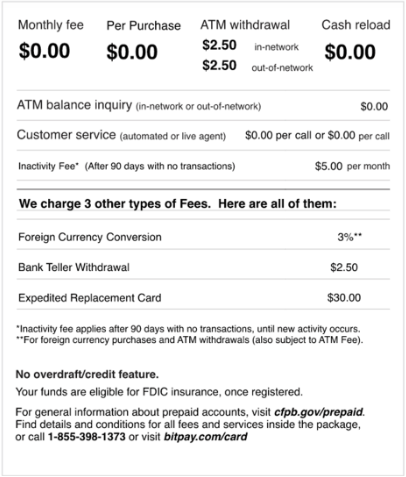

BitPay Pricing and Fees

The BitPay mobile app and wallet can be downloaded free of charge to all consumers, with a small $10 USD fee charged for ordering the BitPay Card. However, they do charge a flat one percent fee on all transactions.

The BitPay card can be seen as a preloaded cryptocurrency debit card, which means there are no monthly interest charges and no credit being loaned. There are some additional charges for activities such as ATM withdrawals, inactivity, and foreign currency conversions.

BitPay Card Fees (Source: https://bitpay.com/card/)

BitPay Card Fees (Source: https://bitpay.com/card/) BitPay Company Background

The early days of Bitcoin brought a sense of uncertainty with it, but those who sought to understand it recognized the opportunity. In 2011, Stephen Pair and Jim Aviles founded BitPay when they saw the potential for cryptocurrency to revolutionize the financial industry.

BitPay was founded with the mission of “building blockchain payment technology to transform how businesses and people send, receive, and store money around the world.” [1].

Backed by investors such as Index Ventures, Founders Fund, and RPE Ventures, BitPay continues to strive toward its mission by delivering new products that make crypto payments easy for everyone to use.

How does BitPay work?

BitPay comprises a package of cryptocurrency products designed to make using crypto as easy as possible. Users can download the free BitPay Wallet to store their crypto, NFTs, and other digital assets or use the BitPay Exchange to purchase assets.

The flagship product, the BitPay Card, is essentially a prepaid cryptocurrency debit card. Users can fund the card via fiat currency methods or by transferring cryptocurrency through the BitPay Wallet.

Users can then transact with supported vendors, allowing them to pay with cryptocurrency for everyday products. They can even withdraw cash from an ATM, exchanging crypto for tangible dollars.

BitPay themselves do not provide users any rewards for using the cards, but select vendors may offer cashback rewards for using BitPay as a payment method.

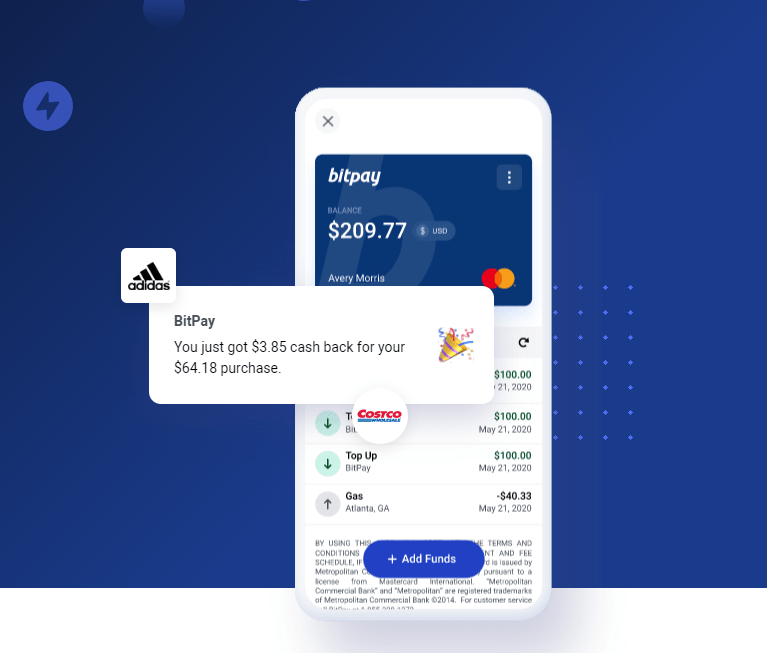

BitPay User Experience

The BitPay user experience is designed to be as intuitive as possible so that all consumers can take advantage of cryptocurrency. The user-friendly mobile app provides a simple interface for customers to manage their assets, track spending, and purchase cryptocurrency. The mobile app works directly with the BitPay Card to fund balances, shop with supported vendors, and send funds directly to others.

BitPay Interface and Card (Source: https://bitpay.com/card)

BitPay Interface and Card (Source: https://bitpay.com/card) What cryptocurrencies are supported on BitPay?

BitPay allows users to shop at over 250 vendors using 16 different cryptocurrencies, including many popular tokens.

Some of the supported tokens include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Polygon (MATIC)

- USD Coin (USDC)

- LiteCoin (LTC)

Security: Is BitPay Safe & Secure?

The security features provided by BitPay may be below industry standards on a platform level, but the self-custody nature of their wallet can provide a safe experience for consumers that accept the responsibility. BitPay also provides encrypted passwords, safety phrases, and two-factor authentication to further secure customer accounts.

There are only a few safeguards against the theft of BitPay cards, therefore, it is up to cardholders to keep their information safe. In the event of theft or a lost card, customers can easily cancel and replace their card and funds by calling the Cardholder Services team.

Customer Support: Contacts & How to Get Help

BitPay provides quick customer support to users who may have issues.

The primary option for support is through the AI live chat found in the bottom right-hand corner of the desktop site. Users can quickly find a solution through this AI chatbot or be transferred to a live agent for further assistance.

For those who prefer to individually troubleshoot their issues, BitPay provides an extensive Help Center complete with FAQs and other insight resources to help with their problems.

Who is BitPay Best For?

BitPay is a comprehensive crypto payment solution that makes using cryptocurrency in everyday life as easy as possible. With a powerful suite of crypto products, consumers can spend their cryptocurrency with ease through online and in-person transactions.

The intuitive mobile app and BitPay Card create a familiar experience for everyday consumers. The ability to shop online through the mobile app or swipe a card at vendors makes crypto transactions simple for novices.

Although the rewards may be limited, the low costs of using BitPay are enticing enough to attract consumers of all levels. With a transaction fee as low as 1%, and a single cost of $10 USD for a card, the BitPay payment solution is an affordable option for all.

For those that may be wary of using cryptocurrency for regular transactions, BitPay has proven to aid the adoption and use of cryptocurrency since 2011. The powerful brand has led to the integration of over 250 vendors, helpful customer service channels, and industry-standard security.