CoinTracker Review: Pros, Cons, and More

CoinTracker

- One-stop software platform for tracking cryptocurrency portfolios and calculating taxes

- 1 million users with over 50 billion worth of crypto assets

- Supports over 10,000 crypto assets in over 300 exchanges

Pros:

- Straightforward design and user-friendly interface

- Specific services for NFT and DeFi assets

- Helps its users to fulfill multiple tax forms such as IRS Form 8489

- Backed by top investors and celebrities

Cons:

- Expensive

- Doesn't support some of the key trading features

- Free plans don't give access to priority customer support.

CoinTracker Ratings and Reviews

CoinTracker is a one-stop software platform for tracking cryptocurrency portfolios and calculating crypto taxes. The platform easily syncs cryptocurrency exchanges and crypto traders’ wallets to build their crypto portfolios and generate tax forms required by IRS and other entities. Users can also import or export CSV files to calculate their taxes.

Trusted by over 1 million users with over 50 billion worth of crypto assets[1], CoinTracker offers various services and tools that allow individuals and businesses to monitor their investment performance, crypto asset portfolios, taxes, and more. Accountants can also register to CoinTracker to track their clients’ cryptocurrency transactions and generate tax reports.

The crypto tax platform supports over 10,000 crypto assets in over 300 exchanges[2], NFTs, and DeFi assets. CoinTracker users can access CoinTracker NFT Center by syncing their wallets to manage their NFT portfolio, calculate NFT taxes and determine taxable gains or losses.

While crypto tax calculation by connecting seamlessly to wallets is the main selling point for CoinTracker, the platform also provides money-saving tips.

CoinTracker Homepage (Source: https://www.cointracker.io/)

CoinTracker Homepage (Source: https://www.cointracker.io/) Highlights of CoinTracker

- CoinTracker has a straightforward design and user-friendly interface. Beginner crypto traders can easily use CoinTracker to monitor their crypto portfolios and generate tax forms.

- The platform integrates flawlessly with users’ wallets in over 300 cryptocurrency exchanges and the leading NFT platform, OpenSea.

- CoinTracker provides advanced portfolio tracking options, charts, and specific services for NFT and DeFi assets.

- CoinTracker can calculate taxes for over a hundred countries and generate country-specific documentation for the United States, Canada, the United Kingdom, and Australia.

- The platform allows the import and export of CSV files to other devices.

- Crypto tax platform helps its users to fulfill multiple forms such as IRS Form 8489, Schedule D, Schedule 1, and IRS Form 1040 and enables its users to file them directly with TurboTax, H&R Block, or their own accountants.

- CoinTracker is backed by top investors and celebrities such as Coinbase, Y Combinator, Serena Williams, and more.

Risks of using CoinTracker

- CoinTracker has various features for tracking cryptocurrency portfolios; however, some are only available for pro or premium plans.

- CoinTracker’s pro and premium plans start from $99/month, which is expensive.

- Modifying some transactions can be challenging for users who prefer to upload them with CSV files without linking their wallets.

- Customer support with email is only available in paid plans. Users with free plans don’t have access to priority support.

- CoinTracker doesn’t support some of the key trading features such as swaps, derivatives, and futures.

CoinTracker Features

CoinTracker stands out from the competition with its unique feature offerings that include:

- Monitoring Crypto Wallets and Portfolio Performance: Users can link their crypto wallets to CoinTracker to track transactions for Bitcoin and over 10,000 crypto assets. They can also calculate their investment performance and the rate of their ROI.

- Multiple Accounting Methods: CoinTracker users can choose different accounting methods while generating their tax forms, such as First In First Out (FIFO), Highest In First Out (HIFO), and Last In First Out (LIFO).

- Tax Loss Harvesting: CoinTracker’s tax loss harvesting feature enables users to offset their losses against certain gains in their cryptocurrency transactions. The platform aims to optimize users’ taxes as harvestable losses.

- Tax Impact: CoinTracker calculates its users’ upcoming transactions to estimate taxable gains.

CoinTracker also provides must-have products for individuals and businesses, such as:

- Crypto Portfolio Assistant: The platform’s main feature unifies users’ transaction history across every crypto service and enables portfolio allocation in real time. The Crypto Portfolio Assistant feature also helps users tax-loss harvest and monitor unrealized performance over-determined periods.

- Crypto Taxes: Key tool of CoinTracker, which includes an automated crypto tax calculator that analyzes users’ transactions to generate tax forms for filing end-of-year capital gains and taxable income.

- NFT Center: Similar to its crypto services, CoinTracker provides NFT Center for tracking and managing its users’ NFTs. In the Center, users can also calculate their NFT taxes, gains/losses, and cost basis. NFT Center has a free plan without customer support and advanced features. Users who often trade NFTs can choose Enthusiast, Pro, or Custom Plans.

- For Accountants: CoinTracker users can invite their accountants on the platform to file related forms and reports to the authorities. Accountants can also subscribe to CoinTracker to serve their clients trading crypto assets and NFTs.

- Enterprise: CoinTracker provides white-labeled solutions to businesses with advanced features for tax compliance. With CoinTracker’s software technology, enterprises can offer their customers to optimize their tax positions.

- DeFi: Different from buying and selling cryptocurrencies, DeFi transactions can include such activities as borrowing, participating in staking and liquidity pools, earning interests, and yield farming. CoinTracker implements different taxes for these transactions under their DeFi Center tool and service.

CoinTracker Pricing & Fees

CoinTracker has various plans for its different web3 services and tools:

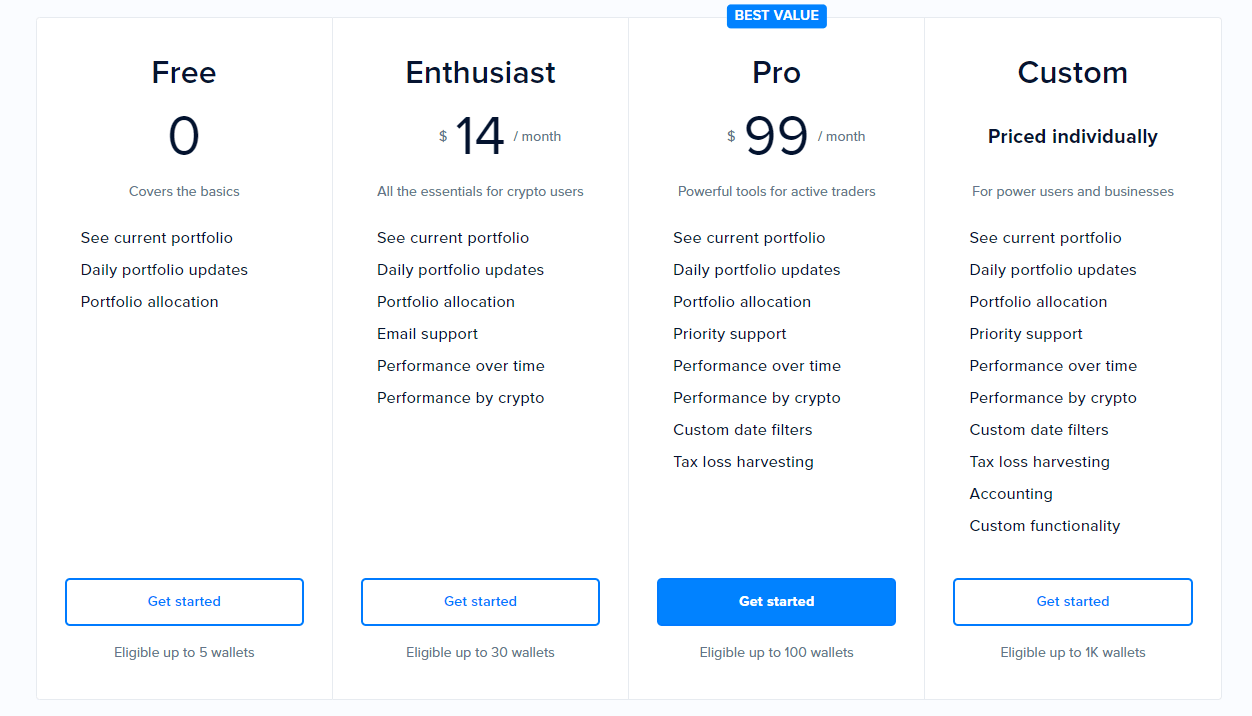

- Crypto Portfolio Assistant and NFT Center have a free plan and a free trial period with limited features. At the end of the trial, users can choose Enthusiast, Pro, or Custom Plans.

CoinTracker Crypto Portfolio Assistant and NFT Center Pricing (Source: https://www.cointracker.io/portfolio/subscription and https://www.cointracker.io/nft-landing)

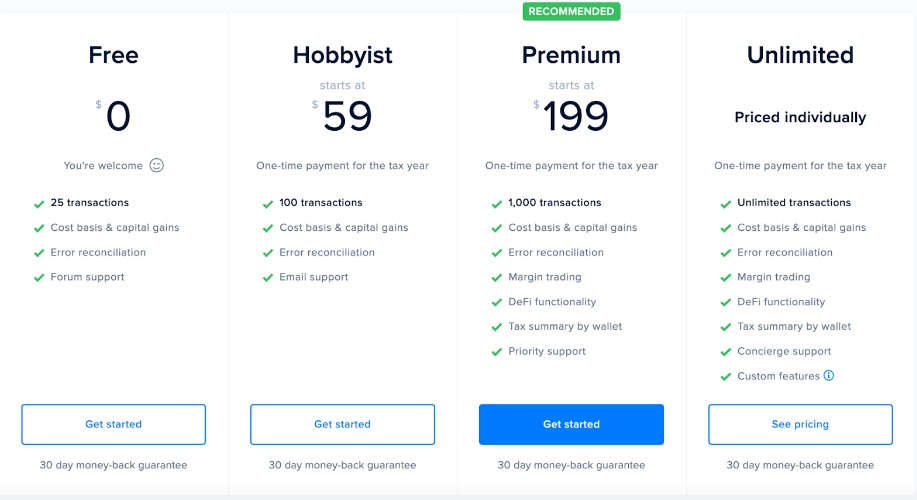

CoinTracker Crypto Portfolio Assistant and NFT Center Pricing (Source: https://www.cointracker.io/portfolio/subscription and https://www.cointracker.io/nft-landing) - Crypto Taxes also has a free plan limited to 25 transactions and basic features. Users with more transactions can choose Hobbyist, Premium, or Unlimited plans.

CoinTracker Crypto Taxes Pricing (Source: https://www.cointracker.io/tax/2021/plans)

CoinTracker Crypto Taxes Pricing (Source: https://www.cointracker.io/tax/2021/plans) CoinTracker Company Background

CoinTracker was founded by Chandan Lodha and Jon Lerner in 2017 in San Francisco, California. Specialized in tracking and generating tax forms for digital currencies and assets, CoinTracker is backed by Accel, General Catalyst, Initialized Capital, Y Combinator, 776 Ventures, and other leading investors such as Serena Williams.

CoinTracker became the exclusive cryptocurrency tax partner for many top crypto exchanges and tax products, including Coinbase, OpenSea, Intuit’s TurboTax, and Blockchain.com.

In 2020, the company raised $100 million in series A at a $1.3 Billion valuation[3] and activated various features on the platform’s dashboard. One year later, CoinTracker partnered with Coinbase to target US users to facilitate their crypto and NFT assets tax filing.

The software platform continues to develop the features providing its services in over a hundred countries.

How does CoinTracker Work?

To use CoinTracker services, users can visit cointracker.io website or download CoinTracker mobile app available on iOS and Android.

After clicking on the Get Started button and choosing the service and the plan, users can decide to access the CoinTracker dashboard to proceed. On the dashboard, users can connect all their wallets with different methods according to the crypto exchange platform.

All the details about syncing the exchange wallets are provided in the CoinTracker Support section. After connecting wallets, users can monitor their portfolios and easily generate tax forms.

CoinTracker Supported Crypto Exchanges

CoinTracker supports over 300 exchanges, including;

- Coinbase and Coinbase Pro

- Binance and Binance.US

- WazirX

- KuCoin

- Bittrex

- Bitfinex

- Gemini

- Huobi

- Kraken

- Poloniex

A complete list of CoinTracker’s supported crypto exchanges can be found on CoinTracker’s website in the Integration section.

CoinTracker Supported Wallets

CoinTracker integrates both with the major hardware and software wallets, including;

- TrustWallet

- MetaMask

- Ledger

- Trezor

- eToro

- Uniswap

- 1inch

- Jaxx

- Casa

- Compound

More details on support wallets can be found on the company’s website.

Security: Is CoinTracker Safe & Secure?

Security is one of the selling points of CoinTracker. On their website, CoinTracker explains that their employees must pass a thorough background check before hiring.

CoinTracker never asks for private keys, and all the API keys on the users’ exchange accounts are encrypted and securely stored. The platform also enables security on its website with SQL injection filters and supporting token-based two-factor authentication.

Certified as SOC 2 compliant, a certificate created by The American Institute of CPAs (AICPA), CoinTracker also has periodic security audits to check for any vulnerability on the platform. No hacking or suspicious activity has been reported since CoinTracker began its operation.

Users can report any potentially suspicious activity to security@cointracker.io.

Customer Support: Contacts & How to Get Help

CoinTracker provides various customer support methods with a responsive support team. Users having questions about transactions, account access, and wallet syncing can reach out to the CoinTracker team by submitting a ticket. CoinTracker has a Twitter account dedicated to customer support. Users also contact CoinTracker by sending DMs to CoinTracker_CS.

On the CoinTracker website, there is a Support section with a variety of topics and helpful resources, such as a crypto tax guide, a blog, and an FAQ section. When the resources are inadequate, users can log in to the Community section and post their questions.

According to the chosen plan, CoinTracker users can also have priority support offering faster support with more features.

Who is CoinTracker Best For?

CoinTracker is a secure crypto tax and portfolio management platform with easy integration with hundreds of crypto exchanges and wallets.

CoinTracker is suitable for beginner and advanced crypto traders looking for a solution to file taxes while monitoring their transactions in various cryptocurrency exchanges. With its user-friendly dashboard and support section, CoinTracker facilitates the crypto tax filing process for its users. Users who hold NFTs and DeFi assets can benefit from NFT Center and DeFi Center to generate specific tax forms.

Since filing crypto and NFT tax forms can be complicated, US residents can choose CoinTracker to avoid misinformed authorities such as the IRS. Operating as an all-in-one crypto taxing and monitoring platform, CoinTracker also provides helpful money-saving tips with tax loss harvesting and tax impact features. Users must pay higher monthly fees to access the platform’s advanced features.