Most people don’t understand exactly what "alternative investments" are. Hearing the term, you might think "hedge funds" or other vehicles only the wealthy have access to. But there are many kinds of alternative investments and many are accessible to all kinds of investors.

Alternatives are on the rise. The global assets under management of alternative investments has risen by 119% over the last eight years, to $8.1 trillion in 2013, according to McKinsey & Company.

As alternative investments become increasingly popular, it’s important that advisers and investors understand them better. Here are the top three misconceptions about alternative investments:

1. Alternative Investments Are Inherently More Risky

The term "alternative investments" encompasses an extremely wide range of opportunities, from rare coins to sustainable farmland. Pretty much anything that does not fall within the definition of traditional stocks and bonds can be loosely categorized as alternative investments. The more common alternative investments many are familiar with are venture capital, private equity, hedge funds, and fixed-income products.

Alternative investments often get a bad reputation due to the fact that they are largely unregulated, illiquid, and have historically demonstrated lower visibility and accessibility. However, the illiquid and unregulated nature of alternative investments do not inherently imply more risk. As reflected in a 2013 report on private equity performance, illiquidity reflects a 3% return premium over more liquid assets. While illiquidity is viewed as an additional risk, in reality, it simply reflects the lifetime and nature of the product. Consider, for instance, the $444 billion that Leon Black and Henry Kravis handed back to their investors in the first half of 2014, marking a more than 40% increase from the same period in 2013.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

2. Alternatives Are Only for the Super-Wealthy

Historically, alternatives have been primarily utilized by the super-wealthy and institutional investors such as pensions and endowments. This is largely due to their timeline and tolerance for illiquidity. However, there is another explanation for why alternatives have been reserved for the super wealthy.

Until September of 2013, Reg D offerings utilizing the Rule 506 exemption (most widely used exemption for private offerings) were not permitted to engage in general solicitation or advertising. This created an environment in which everyday investors were historically unable to access or view these offerings. With recent regulatory changes, there are online platforms that are leveling the playing field by permitting the broader community of accredited investors to access new, portfolio-enhancing opportunities.

3. Alternatives Aren’t Necessary for Investment Portfolios

With the overabundance of financial products on the market, it is sometimes mistaken that the incorporation of true alternative investments is not required for a well-balanced investment portfolio. However, it is widely known that alternative investments have the potential to enhance the risk and return characteristics of a portfolio. Alternative investments feature low correlation to overall market dynamics and thus provide a great volatility dampener. Additionally, the illiquid nature of alternative investments can benefit investors by discouraging behavior-based trading.

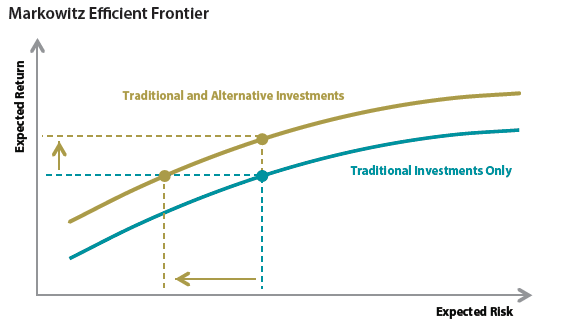

There are optimal portfolios for a given level of risk, according to Harry Markowitz, who dubbed this concept the efficient frontier (see chart below). Portfolios that tend to have a greater degree of diversification incorporate assets with low correlation and less systematic risk, providing investors with enhanced return potential for a given amount of risk. This further emphasizes the importance of incorporating alternative assets into investment portfolios.

While alternative investments may have the potential to enhance portfolios, they also demonstrate certain complexities that require further due diligence and consideration. With the development of new investment platforms and the increasing demand for transparency, alternative investments are expected to become a central component of investor portfolios.

This article was republished with permission from TheStreet.