While larger "gateway" markets, including New York, San Francisco, Houston, and Washington, among others, continue to attract the lion’s share of commercial real-estate investment capital, some smaller secondary markets with similarly strong growth profiles are beginning to experience considerable investor interest.

There are several huge markets that have stayed attractive to investors in recent years, despite offering only sing-digit returns. San Francisco, San Jose, Houston, Seattle, and several others have demonstrated advantageous population and job growth dynamics. Employment growth in the San Jose area, for instance, outpaced the nation’s last year, with job gains exceeding 4%, and the Bay Area is among the top tier of places where a solid mix of job-creating industries is concentrated. Additionally, Washington, D.C., with its still-substantial government employment base and growing financial services and technology sectors, and Houston, with its enormous energy sector and export machine, remain near the top of any list for investment-in a variety of property sectors. These markets also have landmark, trophy properties that are highly valued.

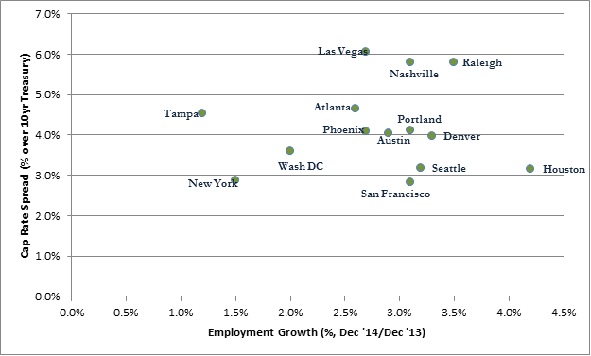

Yet, smaller markets like Portland, Seattle, Denver, Austin, Nashville, Atlanta, Las Vegas, Tampa, Raleigh and Phoenix have strong growth dynamics and are now offering higher returns. They have higher risk because they are less established. But with higher risk comes the added benefit of higher investment yields. By moving up the risk curve to improve returns, one also moves away from landmark, trophy properties in traditional gateway markets to solid opportunities in promising markets with substantial yield potential.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Common denominators among these metropolitan economies include growing (in some cases, burgeoning) technology sectors, healthcare, and financial services industries. Nashville added more than 70,000 new jobs between 2010 and 2013, for instance, a 9% increase. Denver employment rose 7% in the same period. Austin has been on a tear in recent years, rising 11%, with gains in technology and financial services. Even Atlanta, with new technology firms and a growing financial services sector saw 6% growth between 2010 and 2013.

When we look at smaller secondary markets compared to the major gateway cities, we can see that attractive qualities — employment growth, for instance — often compare favorably. And, the relative yield potential in many of those secondary markets can be quite robust. Compared to a 10-year treasury, an investor can realize somewhere in the 6% range on an office investment in Nashville, for instance, or Las Vegas or Raleigh, compared to somewhere in the neighborhood of 3% in New York or San Francisco. That three point yield advantage can come in handy when interest rates start to move higher, as they surely will.

Depending on one’s appetite for additional risk, investors might keep in mind that secondary (and tertiary) markets have limited trophy investment opportunities. One might consider core-plus properties (stable properties with steady cash flows) or value-added properties (properties that require some enhanced management and which offer lease-up opportunities) where yields might be enhanced still further.

This article was republished with permission from TheStreet.