CoinLedger Review: Pros, Cons, and More

CoinLedger

- Free portfolio tracking tool

- Compatible with traditional tax software

- Tracks income from trading, staking, and NFTs

Pros:

- Free version of the platform available to all users

- Geographically tailored tax reports

- 14-day money-back guarantee

Cons:

- Limited crypto wallet support

- Unpaid users cannot generate tax reports

- Cannot pay for services with cryptocurrency

CoinLedger Ratings and Reviews

CoinLedger is an intuitive crypto tax software that provides an automated solution for transaction tracking and tax reporting. With a range of price plans and a free version, investors of all levels can find insight into their portfolios and tax implications.

With helpful customer support channels, extensive security infrastructure, and a mission-led executive team, CoinLedger provides a safe experience for preparing crypto taxes.

CoinLedger Homepage (Source: https://coinledger.io/)

CoinLedger Homepage (Source: https://coinledger.io/) Highlights of CoinLedger

- CoinLedger aggregates assets with a free portfolio tracking tool.

- Reports generated by CoinLedger are compatible with traditional tax software such as TurboTax.

- Users can track various activities, including income from trading, staking, and NFTs.

- CoinLedger generates geographically tailored tax reports that are compliant with local regulations.

- CoinLedger has processed over $70 billion in user transactions.

- A free version of the platform is available to all users, with many of the most powerful features available.

Risks of using CoinLedger

- CoinLedger has limited crypto wallet support, with only nine options available.

- Unpaid users cannot generate tax reports but have access to many other features.

- Despite support for multiple payment methods, users cannot pay for services with cryptocurrency.

CoinLedger Features

Tax Reports: CoinLedger allows investors to generate compliant tax forms at the click of a button. The automated process makes tax preparation a seamless experience. Users have access to a variety of tax reports, such as:

- Gain and Loss Reports

- Tax Loss Harvesting Reports

- Cryptocurrency Income Reports

- IRS Form 8949

- Audit Trail Reports

Portfolio Tracker: Available to free and paid users, the portfolio tracking tool generates impactful insights into investor portfolios. By consolidating all transactions into one dashboard, users can track trading data, portfolio value, and income data from activities such as staking, lending, and liquidity mining.

NFT Tax Software: Users can consolidate NFTs across multiple chains to view in one place. By syncing their wallets and NFT exchanges, investors can also track their gains and losses from trading NFTs, a feature largely unavailable with other tax softwares.

Crypto Taxes 101: As crypto regulation tightens across the globe, it becomes increasingly important for investors to understand how to navigate their taxes. CoinLedger provides country-specific tax guides, complete with high-level tax information and detailed breakdowns of more intricate activities such as margin trading and donations.

Tax Professionals Suite: CoinLedger provides a customizable suite for tax professionals to easily assist clients with their crypto taxes. With all the same features provided on the platform, tax professionals can invite their clients to CoinLedger, where they will be guided step-by-step on importing their transactions.

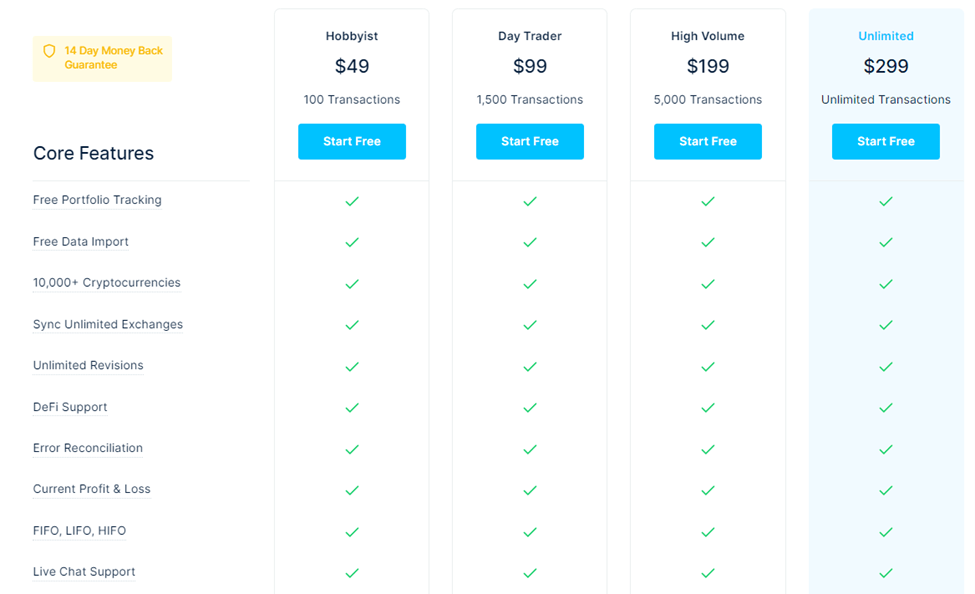

CoinLedger Pricing & Fees

CoinLedger provides cost-efficient pricing options for investors of all levels. Each of the four price plans provides users with the same features, the primary difference being the total transactions supported.

Low-volume users can select the Hobbyist ($49) option, which supports up to 100 transactions, and high-volume users can choose the unlimited ($299) option, which supports unlimited transactions. Each plan is billed once per tax season.

CoinLedger Pricing (Source: https://coinledger.io/pricing)

CoinLedger Pricing (Source: https://coinledger.io/pricing) CoinLedger also provides a free version for users who wish to use the portfolio tracking capabilities. Free users can still import transaction data to consolidate their portfolio data, but they do not have access to automated tax report generation.

CoinLedger Company Background

Formerly known as CryptoTrader.Tax, CoinLedger was founded in 2018 by David Kemmerer, Lucas Wyland, and Mitchell Cookson. The three co-founders were developing automated trading systems to arbitrage crypto exchanges when they realized the difficulties of tracking hundreds of transactions.

Based in Kansas City, Missouri, the team sought to develop a solution to the same problem faced by every crypto investor by creating a platform to track crypto transactions for portfolio and tax reporting. With the mission of building essential tools for the crypto revolution, CoinLedger has become an industry leader in cryptocurrency tax software [1].

How does CoinLedger Work?

CoinLedger provides users with a seamless solution to crypto tax preparation. By automating the process every step of the way, users will find an intuitive and insightful experience.

CoinLedger works by importing all user transactions onto the platform. This is accomplished through syncing supported wallets or directly linking the CoinLedger API to a cryptocurrency exchange.

Once the transaction data has been imported, CoinLedger will automatically consolidate assets for display on a single dashboard. The dashboard provides insightful information into investors’ portfolios, such as trading history, gains and losses, and income generated from activities such as staking or liquidity mining. The dashboard also supports data regarding users’ NFT transactions.

As tax season begins, users can generate a number of compliant tax reports like the IRS Form 8949 (for Schedule D) or a simple gain and loss report. These reports can be submitted directly to regulatory authorities or exported to compatible traditional tax software such as TurboTax, H&R Block, or TaxAct.

CoinLedger Supported Crypto Exchanges

The CoinLedger API can be linked directly to crypto exchanges to automatically import transactions in realtime. CoinLedger offers support for many major exchanges as well as some rare platforms.

Some of the popular exchanges include:

- Coinbase

- Binance

- Gemini

- Kraken

- BlockFi

- KuCoin

CoinLedger Supported Wallets

CoinLedger also allows users to import transactions by syncing supported wallets. Although they only support nine platforms, CoinLedger provides integration to many popular crypto wallets, including but not limited to:

- Exodus

- Metamask

- Trust Wallet

- Abra

- Trezor

- Ledger

Security: Is CoinLedger Safe & Secure?

CoinLedger does not custody user assets on the platform but instead hosts and analyzes the imported data. This extensively reduces the likelihood of attacks, as assailants cannot access funds through CoinLedger.

To keep the personal data hosted on the platform protected, CoinLedger implements several platform security features. Passwords and credentials are hashed using complex encryption standards, with data being protected using 256-bit encryption. All servers are hosted on the CoinLedgers virtual private cloud (VPC), limiting network access from unauthorized individuals.

Because of these thoughtful security features, CoinLedger has managed to operate without any major hacks to date.

Customer Support: Contacts & How to Get Help

CoinLedger provides extensive support options for those experiencing difficulties on the platform. Although there are no options to chat with a live agent, users can reach support by emailing help@coinledger.io or using the extensive help center.

There is also an AI chat option that can be found on the bottom right hand of the screen, where users can receive assistance for minor issues or general questions.

Who is CoinLedger Best For?

CoinLedger is an industry-leading cryptocurrency tax software that provides an intuitive solution to a problem many investors face – taxes. With pricing plans ranging from $49 to $299, CoinLedger provides accessibility to novice investors as well as high-frequency traders with thousands of transactions.

The rare implementation of NFT tracking provides traders with a tool to keep track of their NFT tax implications and cryptocurrency assets. The automated nature of the tax report generation creates a seamless experience for those who typically have difficulties preparing their taxes.

Users have plenty of options to import their transaction history. With support for all major exchanges, investors can directly link their exchange accounts through the CoinLedger API. For those that primarily use major wallets such as MetaMask or Ledger, intra-wallet transactions can be easily tracked.

Beginner users have access to efficient support channels like AI chats and a help center to guide them through any issues they may face. Investors can also find relief that CoinLedger doesn’t hold any assets on the account, with additional protection provided through their impressive security integrations.