In recent years, interest in ESG and sustainable stocks has steadily increased among investors looking to buy into businesses that are perceived to have a conscience. However, with the current post-pandemic IPO boom underway, could ESG recognition pave the way for greater company valuations?

Sustainability may be increasingly at the forefront of investors’ minds but what could this trend mean for businesses looking to maximise their potential when opting to go public?

Passion for ESG Investments

Environmental, social and governance (ESG) stocks have become a key consideration for investors over recent years and their interest in sustainability only appears to have grown in the wake of the Covid-19 pandemic.

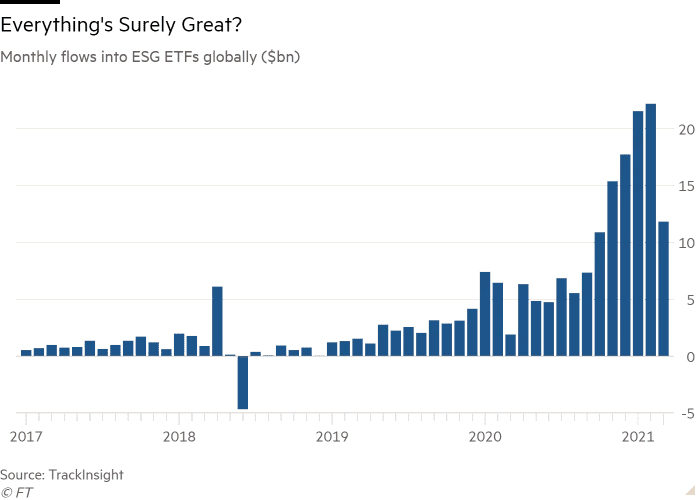

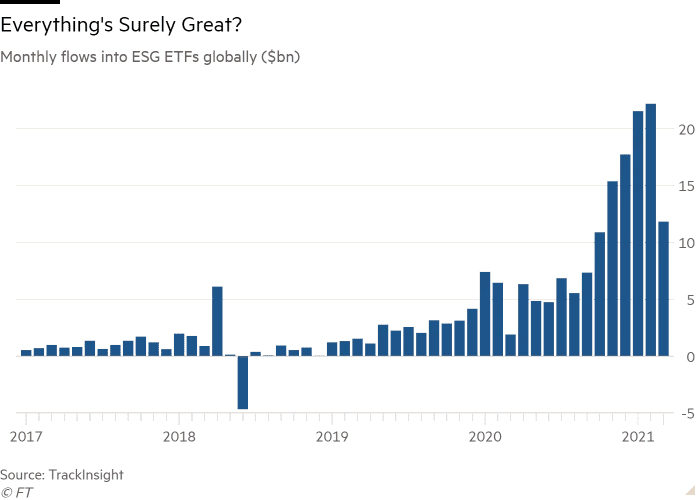

(Image: Financial Times)

As Financial Times data shows, the monthly flows into ESG ETFs globally surpassed $20 billion at the turn of 2021, marking a significant increase over years prior.

According to a recent EY survey that explored the state of investment between 2016 and 2019, the number of investors making ‘frequent’ use of non-financial considerations in their decision making processes increased from 27% to 43% – making ESG reporting much more prominent. In fact, just 9% of investors opted against considering non-financial performance as part of their considerations and only 2% believed that there was no need for a formal framework to measure such factors.

These results show that companies – whether they’re looking to go public with an IPO or are thinking of utilising an IPO as an exit option – must seek to measure and present ESG performance indicators to appeal to this growing market.

Naturally this challenge is only complicated by there not being any agreed ESG reporting standards in place, with the Embankment Project for Inclusive Capitalism identifying as many as 63 possible metrics for measuring sustainability.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Driving Greater Company Valuations

Following on from the aforementioned findings that sustainable stocks are consistently increasing levels of interest among investors, it’s also important to point out that ESG policies can help startups to gain more access to capital and, in turn, lower a company’s cost of capital.

Fundamentally, the investor appeal for sustainable companies stems from emotional drivers. ACF Equity Research suggests that these intangible drivers for greater valuations can extend to factors like higher levels of employee productivity and more appeal for younger investors.

Significantly, the investment research firm defines the key link between ESG companies and huge valuatations thus:

Increased interest in ESG = higher demand for stock = higher performance stock = higher valuation

According to Maxim Manturov, head of investment research at Freedom Finance Europe, the favourable stock market conditions in the wake of the Covid-19 pandemic could also be a driver of interest in sustainable investing.

“When the pandemic started, the market was mostly driven by tech stocks, the so-called stay at home stocks,” Manturov said. “Currently, when the skies are mostly clear and most economies are winning the battle against the pandemic thanks to the vaccines, many sectors that experienced correction or suffered during the COVID lockdown started recovering.”

As confidence in broader markets grew and new retail investors arrived onto the market ready to buy into stocks with a conscience, it provided ESG compliant companies with the opportunity to launch prosperous IPOs that would draw a scale of interest that’s never before been possible.

The Lure of Sustainability

Sustainability has been front and centre of successful IPOs for some time now, with Beyond Meat making one of the most compelling cases for the lure of ESG companies back in 2019.

Beyond Meat’s mission statement is “to create nutritious plant-based meats that taste delicious and deliver a consumer experience indistinguishable from that provided by animal-based meats,” according to its S-1 IPO filing.

Investors and employees alike who were able to buy into the company prior to its IPO saw huge returns on their investment when the company sold almost 3.5 million shares in a secondary offering that priced Beyond Meat at $160 a share – over six-times its original price of $25 during Beyond Meat’s original IPO.

This notable success for Beyond Meat’s IPO is great for other ESG companies looking to go public in the future, and there’s been plenty of evidence that sustainability is still key even amidst 2021’s frenetic IPO market.

In what was billed as one of 2021’s most exciting IPOs, Deliveroo slumped by as much as 30% at one point on its debut on the London Stock Exchange owing to widespread concerns about the company’s treatment of its workers.

The timing of Deliveroo’s IPO itself was marred by a Supreme Court Ruling that classified Uber drivers as workers, and its potential implications for fast food delivery drivers. This issue of fair pay and employee benefits for Deliveroo’s network of gig economy workers is a severe governance issue that hampered the stock’s price in its early months of public life.

On the flipside, we saw more joy for ESG firms as plant-based milk company Oatly soared on its trading debut. Although the Swedish firm set its share price at $17, its value quickly rose to $22, leading to a company valuation of $13 billion.

While the current IPO boom has seen countless companies capitalise on favourable financial years in the wake of the pandemic in order to go public, ESG performance and sustainability are becoming increasingly sought after – particularly among retail investors. Although there’s much to be made of the extensive qualification criteria as to what constitutes an environmental, social and governance stock, it shows that it really can pay to be a company with a conscience in many cases – potentially paving the way for some exciting valuations for compliant businesses.