The resurgence of the second covid wave is making investors nervous, across the globe, about the direction of the financial markets. On one side, we see global economic recovery is being threatened by the second wave and at the same time equity markets are scaling new high now and then. During such uncertain times, it is obvious that investors often get confused about whether to opt for investment avenues related to financial markets. Smart money (nickname for investment banks, hedge funds, etc.) often believe in their abilities to beat the market during times of volatility, however, they also realize in due course that beating the market is not that easy as it appears.

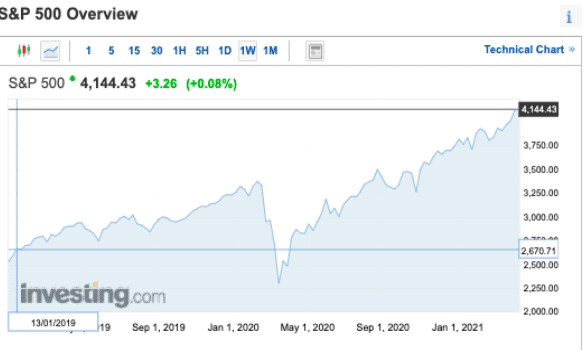

The biggest dilemma for any investor during volatile times is to find the right moment to enter the market. A quick look at the S&P 500 trajectory (Illustration 1, source: investing.com) since the onset of covid-19 depicts the worst nightmare for an investor. During the late Feb – early March period, S&P Index corrected close to 30%. Thanks to the unexpected and drastic recovery of the index, it can be fairly said that anyone who stayed invested during this period made a buck at least. However, not every stark correction generally is accompanied by such swift recovery. It is due to times like these, an average investor gets scared of making investment decisions related to equity markets, citing the riskiness of the investment.

Systematic Investment Plans – SIP as an investment tool has weathered the tests of time and is the go-to tool these days during volatile times for an average investor. Investing process can be made hassle-free and uncomplicated using this instrument without worrying too much about the direction of the financial markets.

What is a SIP?

A systematic investment plan (SIP) allows an investor to invest a fixed amount at a regular interval in different products like a mutual fund, stocks (via trading account), or retirement account like 401(k). The investor can choose the investment amount as well as the interval to their convenience, which could be weekly, monthly, quarterly, etc. Longer the duration of SIP, the higher the accumulation of wealth of the investor over time.

How does SIP work?

The underlying process is simple where an investor invests a fixed amount of money and purchases units of underlying investment (could be a mutual fund, stock or investment into 401(k)). As the investment amount is fixed, however, the price of the underlying keeps moving, so the units purchased by the investor never stays the same. Moreover, the investor of a SIP, just like an ordinary investor, is banking on the market (which is a reflection of the overall economy) going up, however, due to periodicity and distribution of the investment, has insulated the investment from sudden shocks these markets can undergo to some extent.

You set up a SIP with a particular date, say 15th, with the desired amount, say $50, target fund and that’s it! Your investment goal has started, all you need to ensure is to have $50 in your bank for this SIP to work on its own. You do not need to monitor the market daily; however, it is highly recommended to check the performance of your SIP every quarter but after staying invested for at least 3 years. There is no minimum amount for a SIP to start, an investor can invest as much as even $5 in a SIP!

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

Dollar-cost averaging

Once you have started investing in SIP, you will observe that the cost gets averaged over time. You invest a fixed amount and receive units in return. The number of these units vary during every investment as the market never stays at the same level, and it goes through different cycles of bearish (falling) or bullish (rising) phases.

During a rising market, an investor will purchase a smaller number of units, however, it will benefit from the accumulated units from the rising market. And in case of a falling market, the investor will be able to purchase more units but will lose on accumulated units from the falling market. Thus, investor benefits in both, rising as well as falling market, provided the investor does not get disturbed by market movements and ends up closing the SIP. All this leads to averaging of cost of units which was high during bullish times and low during bearish, is called dollar-cost averaging. It is highly recommended to continue SIP especially during times when the market is bottoming out and then wait for its following peak to reap the fruits of patience and resilience.

Power of compounding

Longer the duration of SIP, the higher the power of compounding. Ace investor Warren Buffet made his first investment at the age of 11 (Source: Forbes magazine) and considered compounding as the 8th wonder of the world.

The basic concept of compounding says that not only your initial investment gets you returns but also the returns on the returns generated over time. One just needs to stay invested and through compounding, an average investor can accumulate a good amount of wealth. Suppose you invest $100 in a mutual fund that gave 10% returns, so your investment is $110. Let’s say, the following year also, you stay invested and again the fund gives 10%, so not only you will get 10% on $100 which you initially invested, but you will also get 10% on $10, which were the returns of the previous year, making your investment worth $121. This is a simple depiction of the power of compounding as in this case, the investor has done nothing but has stayed invested in the fund.

Disciplined Investing

One prime characteristic of SIP is making your investment decision free from any psychological bias and helps inculcate investment discipline in your investment life. Going by the concepts of behavioral finance (a sub-field of finance & economics which deals with investor behavior rather than underlying asset) suggests an investor gets more influenced by psychological traits like greed, fear etc., rather than the movement of financial markets. An average investor tends to buy more during peak times as hope-trade (a trade which lacks logic but is full of expectations or hope) expecting markets to go to infinite levels, whereas exactly the opposite is suggested i.e. buy when markets are low and sell when they are at higher levels. SIP, with the scheduling of investment, helps an investor to remove emotions from investing and continue with the discipline of regular investing thereby letting cost average and power of compounding take care of the investment portfolio over the longer term.

Disadvantages of SIP

While we have been focused primarily on the pros of SIP, there are still some financial risks associated with this product. At the end of the day, it is just another method of maximizing your returns while minimizing (note, not eliminating!) market-related risks.

The start and stop of SIP still matter

Though we have discussed the dollar-cost averaging, it is imperative to understand that if you enter when markets are at a peak, you will end up purchasing units at a higher cost. The decisive factor now becomes when you withdraw your SIP corpus because if you withdraw at a time when markets are still not close to what they were earlier, you might end up with negative returns. Not just cost averaging, entry and exit from SIP also plays a vital role in the performance of the SIP.

Lack of control

Once you give standing instructions to the bank, the SIP investment, just like your mortgage EMI will happen. While this indeed promotes investment discipline in an investor, however, this comes at the cost of giving up control on your investment quotient. As an investor, you will have to park your investment acumen in a corner and wait for SIP to do the job for you. This lack of control makes its presence felt typical when markets are looming at their bottom levels for a few days giving opportunities to smart investors to get in, however, SIP investors have already given up that option.

Conclusion

Investment decisions for an individual are quite tricky. Complex nature of numerous investment avenues available today significantly adds to the investor’s confusion. While portfolio allocation (distribution of investment across different asset classes like equity, debt, real estate, 401(k) – retirement planning etc.) approach is generally rightfully recommended by financial advisors, it is products like SIP, which has drastically raised participation levels of the average investor.

One key parameter still is choosing the fund in which SIP is to be done, once that aspect is sorted there are no complications about SIP investments. Investment takes care of itself without getting affected by any psychological biases and over a long period, the investor is surprised with the size of the investment corpus. SIP compared to lump-sum investing significantly reduces the investment risk and treats an investment as a habit rather than an on-the-fly activity.

Key behavioral trait required for this product is patience and regular monitoring (by regular means quarterly or at least six-monthly) to see if the change of the underlying fund is required. Otherwise, it has been a time-tested product during different market phases – peak, bottoms, volatility and saves the investor from the stress of investment decisions during times of turbulence.

So, if you are a patient investor, willing to invest over the longer term, SIP is the product for you.