You cut your teeth as an engineer, developing everything from simple applications to complex distributed systems used by millions of users. Maybe you work for one of the FANG companies (Facebook, Amazon, Netflix, Google), and make six figures. You’ve been thinking about investing in real estate for some time, but you’ve held off because you believe there’s a high barrier to entry. Software is your world. You don’t have extensive knowledge of real estate.

What’s more, you work 60+ hours a week, and because of the amount of work, you don’t have time to study all the various ways of achieving financial freedom. So, you end up investing in stocks or crypto – and here lies a waste of capital allocation for software engineers.

Let’s face it: You didn’t land where you are today because you’re incapable of learning something new and complex. In fact, your expertise, attention to detail, and higher-than-average income make you the perfect candidate for real estate investing.

I decided to write this article to help techies like myself achieve financial freedom through real estate investing. And not only techies. This article is definitely one to read if you’re an engineer, product manager, designer, investment banker, sales manager, or another high-income earner.

Are you playing baseball in golden handcuffs?

What do baseball and golden handcuffs have to do with software engineers getting into real estate? You may not realize it, but most high-income earners like you are in a very sticky situation.

Employees stay with the same company for a variety of reasons. Exciting work. Thrilling challenges. Industry prestige. But of course, the main reasons they stay are the benefits: excellent base salary, stock, health insurance, and matching retirement plans.

All these exceptional benefits are “golden handcuffs.” They’re the juicy perks that encourage high-income employees to stay right where they are instead of seeking new opportunities.

Here’s where software engineers, golden handcuffs, and baseball players collide…

In large tech companies, software engineers can count on multiplying their total compensation by 1.3 every time they’re promoted to the next level. Let’s say you work for one of the FANG companies where compensation is pretty high:

- A junior engineer (SDE 1, E3, fresh grad) makes a $125K base salary + $100K in stock for total compensation of $225K per year.

- A mid-level engineer with 3-4 years experience (SDE II, E4), makes about $165K+ base salary + 130K or more in stock.

- A senior-level engineer (SDE, E5, 5+ years of experience) can easily reach $420K, $200K from base salary.

- Then there are E6s, who constitute approximately 10% of the engineers at FANG companies. E6s earn up to $550K in total compensation. About 5% of E6 Facebook engineers make $700K-$1MM+.

Their salary increases sublinearly by about 10% from one level to the next. Stocks rise superlinearly about 50% from level to level. Now, the stocks that these engineers hold have also increased in value by about 8-10% annually over the last few years. As a result, they contribute to the $700K-$1MM high earners for folks in their late 20s and early 30s.

Don’t get me wrong, being an E6 at Facebook or Amazon is tough. It takes a lot of skill to reach this level. Most E6s have natural technical talent and graduated at the top of their class. These are true “high performers.”

But if you’re an E6 who’s coding, mentoring, providing technical vision and strategy, and leading your entire team’s technical charter – you end up working 60+ hours per week. Can you continue to meet such high demands for the next 5, 10, 15 years?

The younger techs can.

Paul Peebles from Old Capital calls this phenomenon the “baseball player effect.” Fresh tech grads earn almost the same amount of money as lower league baseball players. Plus, their careers peak in the mid-30s. After that, they compete with the “fresh blood” who eagerly churn out 60+ hour weeks without issue.

It’s the same for software engineers. Once you’re in the mid-30s, you hit the peak in your career. Then, your career and compensation stop growing at the same rate as before, eventually coming to a standstill.

You have an exact window of time to distribute your resources wisely so you can afford early retirement and comfortable life without depending on an employer.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

When it comes to investing, time is of the essence.

If you work and live in California, like most techies, you pay the government up to 50% of your income. As a result, even if you make $800K a year, you’re left with only $400K.

Most California-based techies live in shiny houses, costing $2MM on average. With a 20% down payment, you then pay $10K for the monthly mortgage. You’re now left with $23K per month for all other expenses.

Now add the family, kids, expensive cars, and vacation to the equation. All of this can cost up to $10K per month, leaving you with only about $150K per year to invest. Talk about lackluster!

And what if you only earn $500K annually? If your career and income peak in your mid-30s, you’ll need to allocate your funds wisely (while you still can) in the growth stage.

But here we are again: Working 60+ hours per week with no time to explore investment options. Let’s talk about how to change that.

Real Estate vs. Stocks

We can’t go into a head-to-head comparison of real estate vs. stocks because it’s like comparing apples to oranges. The factors that affect stocks or real estate values and returns are very distinct.

But, here are some thoughts I’d like to share with you on this topic:

It’s safe to say that most techies invest in the stock market because they think it doesn’t require that much research or money. When you buy stocks, you own a piece of that company. Consequently, you make money with value appreciation and dividends.

Then there’s real estate investing…

There’s a massive misconception that real estate investing requires a substantial initial investment and tons of time researching the market.

However, the ways you make ROI on stocks vs. real estate are entirely different. That’s why portfolio diversification is paramount.

With real estate, you acquire physical property. One of the most popular and sustainable ways to make money from real estate is by collecting rent. Another way is through appreciation – capitalizing on increased property value. Lastly, you can pay down your loan principal.

The advantage of real estate is that it is a tangible, diversifiable asset that you can control. In addition, real estate investing offers you some substantial tax benefits. Despite not having similar liquidity as the stock market, it provides long-term cash flow and passive income to help you retire early.

Real estate returns vs. stocks

Most syndications offer 6-8% cash on cash return and 10-12% total annualized return. It’s certainly better than the stock market, period. Yes, you could argue that real estate can take a hit during economic recessions. But this applies to the stock market too.

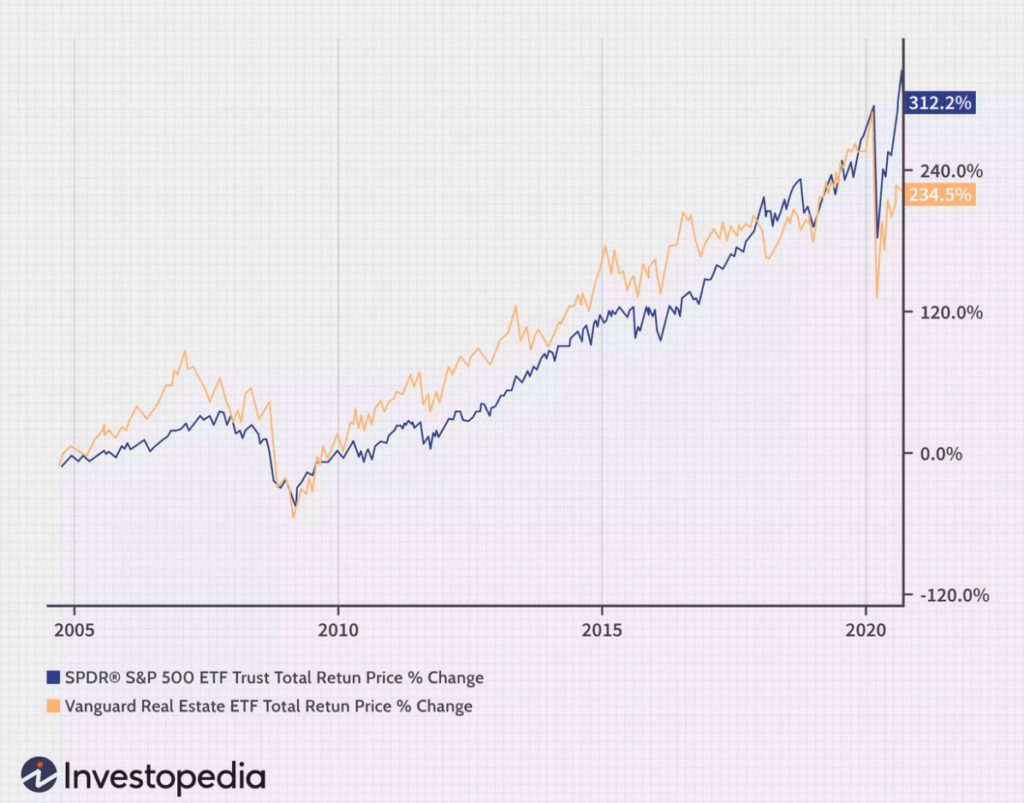

Here is a comparison of the total returns of the SPDR S&P 500 ETF (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) for the last 17 years:

Image by Sabrina Jiang © Investopedia 2020

Image by Sabrina Jiang © Investopedia 2020

Should you syndicate your own deal?

Real estate syndication consists of two parties. One group is the syndicators, who do all the work for you, such as finding and evaluating deals, getting the property under contract, hiring and overseeing the property management company, executing the business plan, and finally disposing of the property. The other group is the passive investors – they don’t do any work but invest $50K, $100K, or $150K. They do this so they can buy a large piece of real estate that they cannot buy otherwise individually. Syndicators make extra due to their sweat equity.

There are 2 types of people out there. Knowing which one you are will help you decide if being a real estate syndicator is right for you:

- First, there are high-income earners who believe they don’t have the time or interest to invest in real estate syndication. While that may be true, it’s problematic because not investing in real estate is a waste of capital allocation.

- Second, there are low-income earners who believe syndication is the way out of their situation. This is problematic because the quality of syndication is not that high.

I am a real estate syndicator myself and have invested in more than 1,500 units. I’m also a lead syndicator on two deals totaling 580 units. Let’s explore the pros and cons of becoming a real estate syndicator.

Pros and cons of being a real estate syndicator

Have you been visualizing yourself traveling the world while the income keeps rolling in from your investments? That might be your goal, but here are other benefits of real estate syndication:

Pros

- Steady wealth building. Although it often starts at a slow pace ($50K per year), once you buy your 400 and 500-unit properties, you may be able to replace your current income in as little as 3-4 years. However, these initial years do require a fair amount of work.

- Invaluable skills. The experience and skills gained by syndicating your deals are hard to acquire elsewhere. You learn asset management, how to stay in the game, and how to build a strong network of multifamily vendors, such as brokers and lenders. Even if you decide to buy multifamily independently without doing syndication, these skills are invaluable. However, make sure you enjoy the day-to-day of being a real estate syndicator.

- Great retirement is more than possible. When you commit to syndication and managing your assets, early retirement for your high-income lifestyle is within reach and sustainable.

Before you make a decision, here is a list of reasons why syndicating while having a high-income job is not necessarily worth it:

Cons

- Initial ROI vs. time spent. A sponsorship team makes around $1K per unit a year. The cash on cash ratio vs. property appreciation ratio is approximately 2:1. For example, if you purchase a 150-unit multifamily property, the sponsorship team earns around $150K per year. So, if you have 3 people on the team, you each end up with $50K per year, including appreciation. Without appreciation (only cash flow and asset management fees), it’s $33K per person annually. Those looking to replace their after-tax income from a W2 job will need 1,000 units to make $1M/3 = $333K a year in a 3-person sponsorship team.

- Risk and responsibility. Imagine being responsible for that much equity under management while only making $333K per year. Is it truly worth it? Take a moment to consider this before making a decision!

The bottom line: Real estate syndication is not rocket science. It’s mostly hard work, a little bit of research, and 5th-grade spreadsheet skills.

How to passively invest in real estate

If you’re a high-income earner and don’t have enough time to do research, passively investing with real estate syndication is your way to go.

It surprises me that while syndication provides an excellent resource for passive income, I’ve hardly met any FANG engineers in real estate syndication mentoring groups. It’s unfortunate because real estate syndication offers high-income techies an opportunity to diversify their portfolios and enjoy early retirement.

You don’t have to “work your way up” or spend a lot of time becoming a syndicator or general partner yourself. Passively invest in syndications!

Here’s an example of what that looks like:

I work in the tech world (engineering manager at Lyft). A few of my friends invest in my real estate deals. I take care of their tax filings, so I may have to call them from time to time.

While I’m doing all the paperwork, they’re out in Hawaii just surfing and enjoying life. Sometimes I get jealous. Why am I doing all this for them while they’re not working for any of the money that’s coming in?

That’s the power of passive investment in real estate. The return on your time equals infinity – especially if you have someone like myself doing the work for you.

A roadmap for software engineers looking to diversify into real estate

Diversifying your portfolio into real estate doesn’t have to be complicated. Here’s what to do:

- Dive to blogs and podcasts to learn about real estate syndication. I’ve put together a list of real estate investing podcasts and a list of real estate syndication blogs.

- Buy your first rental property. Use it as a learning curve before investing in syndication. Once you experience being a landlord you’ll value all the effort that goes into keeping a rental property operating smoothly.

- Buy a house-hacking home. It will help you save a lot of money on mortgage payments and invest it into real estate. If your spouse doesn’t want to share the house, go for something that doesn’t cost $2MM.

- Passively invest in syndication, but check the syndicator’s background and track record. With Cash Flow Portal, we take care of this for you. On our platform, you can easily talk to them, check their references – even connect to meet for coffee! Make sure they are responsive, confident, and experienced. Check online reviews of the syndicator.

- Network with syndicators. Cash Flow Portal offers a simple way to connect with syndicators, vet them, and passively invest in their deals.

Author Bio

Perry Zheng is the founder and CEO of Cash Flow Portal, a real estate syndication software. He lives in Seattle, where he owns six single-family properties. Perry started real estate syndication three years ago. Today, he has more than 1500 units, raised over $16M, and is a lead syndicator on two deals totaling 580 units.

His goal is to help other syndicators succeed and overcome common challenges like raising capital and finding deals even while having full-time jobs. Perry is also a full-time engineering manager at Lyft. He worked at Twitter and Amazon before that.