You might have a great idea and better business plan, but you need more than that to succeed at business. Specifically, you need to understand how to keep your books straight if you want any hope of staying in the black. That means you need to know how to wrangle your invoices.

Invoicing seems like a straightforward system ― you send your clients invoices and they send money back ― but the truth is there are dozens of necessary steps that make the process both complex and delicate. In order to keep seeing payments come in, you must manage your invoices just-so. Fortunately, even if you aren’t an invoicing wiz, it doesn’t take much work to learn the basics. Here are a few tips to get you started on the right invoicing path.

The Format

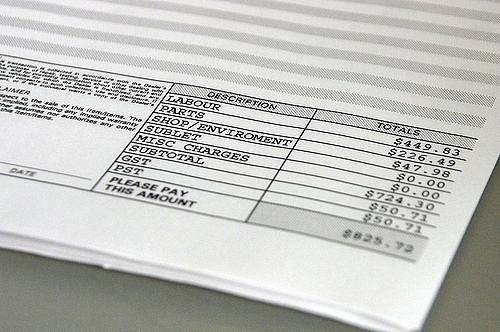

Every business’s invoices are different ― but only just. For the most part, your invoice should adhere to a standard template to ensure your clients understand the document. While you do have some ability to customize your invoice format to your business’s needs and tastes, there are a few invoice features you should definitely include:

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

- Legal information. To be a legal invoice, there are a few necessities your document must contain, such as: the word “invoice,” an identification number, your business’s name and contact info, your client’s name and contact info, the date, and the amount owed.

- Branding. In addition to your business name and contact info, your invoices should fit your business’s brand. You can add logos, fonts, color schemes, and other elements that conform with your brand’s image.

- Descriptions. Each item should include a brief description. Generic terms like “marketing services” can confuse clients, who might then argue the charges and delay payment.

- Prices. You must ensure the prices you list match the prices you agreed upon with clients.

- Payment options. Clients like things easy, and by providing links or directions for payment, you are more likely to get your money faster.

The Terms

It is imperative that you discuss invoicing terms clearly and carefully with your clients so you both know what to expect come payment time. For example, your clients should know how frequently invoices will go out ― every two weeks or once per month? ― when the payment window begins ― when they receive the invoice or when you send it? ― and what the repercussions they face with late payments. You can negotiate these terms with individual clients, but it is best to have a standard set of terms to make the process faster. No matter what, you should always include a hard-and-fast due date on every invoice you send.

The Follow-Up

Every business, new and old, has to deal with unpaid invoices. The best solution is to follow up with clients after you send them invoices but before the invoice becomes delinquent. Regular emails remind your clients that they have (or had) a business commitment with you and that you earned payment. However, once an invoice officially becomes late, follow-up communication becomes absolutely necessary. After 30 days without payment, persistent emails and phone calls are acceptable; at the very least, you deserve a reason for the delay.

However, at least once (but could be more) you will fail to make contact with your delinquent client and lose that source of payment completely. Fortunately, you can still earn some money from those deals by invoice financing. This service allows you to sell your unpaid invoices for slightly less than you are owed; then, the factoring company pursues those debts while you continue doing business with more reputable clients. Invoice factoring is also useful when you know you have clients that pay slowly, but you need funds sooner.

The Filing

One of the most underrated steps in the process of invoicing is organizing your files. To keep track of your paid and unpaid invoices, you need to develop a filing strategy that makes sense to you. Perhaps you can have a “unpaid” box that you can review every day, and once a client delivers payment, you can move that invoice to a “paid” folder. Every office is different, which means another method might make more sense for your style. However, a disorganized pile of files ― whether they are digital or physical ― will not help your business thrive.

The Software

Invoicing is complicated, but it is slightly less complicated when you use the right tools. The following software is some of the best in the business for building templates, tracking projects, communicating with clients, and getting paid.