Cryptocurrency has proven to be beyond the trend, with many investors relying on short-term trades and long-term holding to make unbelievable returns. Even with the perceived instability of some coins, crypto-traders are all the more willing to invest, re-invest, and enjoy ROIs uncommon to more conventional investment portfolios like FOREX and stocks. Today, firms have sprung up, offering investors the opportunity to trade and earn high returns from depositing their cryptocurrency.

And that’s why we are here. Many people ask, ‘how do you earn interest on crypto? What are the risks? How much earning from cryptocurrency is guaranteed?’

And that’s why we are here. Many people ask, ‘how do you earn interest on crypto? What are the risks? How much earning from cryptocurrency is guaranteed?’

The direct answers are, yes, you can earn interest from depositing your crypto, and investors may lose some/all of their investment portfolio when they deposit their cryptocurrencies for interests.

Contents

- How Earning Interests through Crypto Works 1

- What is the Average Annual Percentage Yield on a Crypto Interest Account? 2

- Risks of Operating an Interest Earning Crypto Interest Accounts 2

- Cyberattacks 3

- Employee Theft 3

- Loss Incurred from Loan Defaults 3

- Unavailability of Intensive Regulation 4

- Fall of Cryptocurrency Prices 4

- Final Words 4

How Earning Interests through Crypto Works

Earning interest from depositing your cryptocurrency works within the same principles as banks’ savings accounts.

Banks advise you to deposit some of your money with them. In the case of a crypto interest-earning account, the client deposits their Bitcoin or any altcoin.

Instead of letting the money sit in their vaults, banks trade the money in two ways:

- By lending your money to businesses at an interest rate that is higher than the depositor’s interest.

- By investing your money in high-yielding portfolios.

When you open an interest-yielding account with, say, Blockfi, the company lends your crypto to high-yielding clients at an interest rate and then pays you from the profit they make. Reputable firms that offer interest accounts allow fast withdrawal of capital and interest, although customers may incur withdrawals charges.

While the idea of interest-yielding crypto accounts gains grounds amongst investors, you must understand that the companies that offer the service are not banks; hence, your money isn’t as secured as it would be if you invested in a Fixed Deposit Account with a bank.

What is the Average Annual Percentage Yield on a Crypto Interest Account?

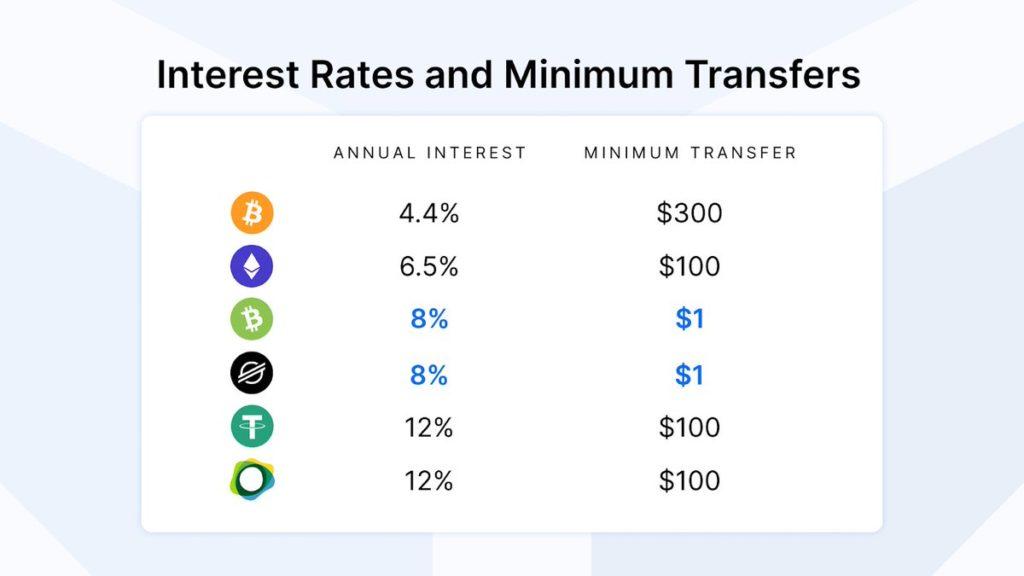

APY on crypto interest accounts varies from company to company and from coin to coin; however, the average interest rate on a crypto interest account can be as high as 8.25%, as in the case of Blockfi. The highest APY on a savings account is 0.7%—offered by SallieMae’s SmartyPig Account. The FDIC offers a 0.06% APY on savings.

Crypto interest-earning accounts yield magnanimously high investment returns. However, the high returns come with high risks.

Risks of Operating an Interest Earning Crypto Interest Accounts

Crypto interest accounts are becoming popular, but they have unmitigated risks. Blockfi, one of the most reputable crypto yield companies, boasts of over a million verified clients and manages over ten billion dollars in assets. Decentralized Finance, DeFi, assets grew from just under a billion dollars in June 2020 to about forty billion dollars in January. While the yields may be tempting, you must understand the risk of the scheme and how best to protect yourself.

Cyberattacks

Cyber-attacks remain one of the greatest risks for crypto-traders. In a moment, your bitcoin or altcoin stock can be moved into your hot wallet and wiped out. What’s worse, most crypto interest-yielding platforms do not cover you for whatever losses you incur. Of course, a few companies flaunt their insurance policies in the case of a cyber-attack; however, these policies can only go so far; hence, you must research the security protocols of any yielding platform before you invest. For example, Gemini, a yielding company, ensures the highest level of security, including:

- SOC1 Type 2 and SOC2 Type 2 Compliant—Gemini remains the only crypto-yielding company with such certification.

- Insurance coverage on all crypto held.

- Hardware security keys.

- Rate limiting withdrawals, address-limiting withdrawals, and 2FA.

Employee Theft

Let’s reiterate that a yielding crypto account works in this way:

- You deposit your crypto into the interest-earning account.

- The executors of your deposit lend your crypto—and other depositors’, for a profit.

- You and the company share in the interest (according to an agreement).

The plan is almost foolproof, except nothing is foolproof, and executives of the company can mismanage your funds, as in the case of Cred.

Cred, a company that around $100 million of depositors’ cryptocurrencies, filed for bankruptcy after they claimed that an investment manager misappropriated 800BTC. Today, 800BTC is worth around $10million. Depositors are losing because there is no assurance that they will ever see their hard-earned coins again.

Loss Incurred from Loan Defaults

Cryptocurrency lending is still very much unregulated. Unlike the banking industry, where the Federal Government monitors investment for quality assurance, the crypto world is still relatively young, with incredible technological backing that may be difficult for regulators to fully grasp. That said, while all top crypto-yielding platforms promise arduous vetting of potential borrowers, you cannot overlook human error. Take Cred, the company’s bankruptcy is connected to mismanagement of 800BTC and another 30million dollars worth of bad cryptocurrency loans lent to a Chinese firm.

Some cryptocurrency interest-yielding firms even conduct trades—a practice highly frowned upon by the FDIC and stiffly regulated by the Volcker rule. The practice remains largely unregulated by crypto banks that collect deposits, putting depositors at risk. Without broad-based regulations, you can only hope that the company lends money out with your best interest at heart.

Unavailability of Intensive Regulation

Suppose you think the banking industry leaders are only given pats on their backs after disastrous financial crises, like the 2008 financial crisis. In that case, you should take a closer look at the cryptocurrency world. The Federal Deposit Insurance Commission and legislators seem not to have any security framework to protect cryptocurrency investors. The situation seems to reflect the days when investment bankers could do as they wished. Fortunately, the Blockchain framework upon which bitcoin and most altcoins are mined have self-regulatory features; however, you must understand that the FDIC regulations are not enough to protect you in the case of mismanagement, theft, or cyber-attacks.

Fall of Cryptocurrency Prices

Bitcoin and altcoins can fall, wiping whatever APY you hoped to get. Unlike cash deposited in the bank—with an almost predictable inflation rate, cryptocurrencies can drop sharply in prices, leading to loss of capital and interest. Some companies may market their tokens—promising you attractive incentives for depositing in their less-known tokens, rather popular ones. Depositing in an unknown token may yield mouth-watering ROI—as seen in many cases; however, it comes with its risks.

Final Words

Crypto trading alone comes with its risks, lending increases the risks, and the worst can happen anytime without proper oversight.

Is earning interest with crypto a good investment strategy? Yes; however, before you dump your whole coins, remember the words of Dan Held, ‘Never risk your whole stack, and don’t risk what you cannot lose.’

You can enhance your trading experience with a full-featured exchange platform by Changelly. They have a multi-currency wallet to store a variety of coin as well as interactive and customizable trading terminal.

YouHodler has the highest loan-to-value ratio (90%) with minimum loan amounts starting at just $100. YouHodler accepts more than 50 top coins as collateral.

More importantly, if you want to earn a high interest from your deposits, you should deposit in the Gemini and Blockfi platforms within appropriate security and compliance frameworks.

References

Shashank Jacob, ‘Here’s Everything You Need to Know about Interest-Earning Crypto Accounts.’ September 20, 2020. Retrieved from: https://finance.yahoo.com/news/heres-everything-know-interest-earning-120658712.html

Brandon Kochkodin, ‘You Can Earn 6% Interest on Bitcoin. Is It Worth It?’ May 17, 2021. Retrieved from: https://www.bloomberg.com/news/articles/2021-05-17/bitcoin-interest-is-crypto-savings-account-worth-the-risk

CFA Institute, ‘Volcker Rule and Proprietary Trading.’ (n.d.) Retrieved from: https://www.cfainstitute.org/en/advocacy/issues/volcker-rule#sort=%40pubbrowsedate%20descending

Nathan DiCaamillo, ‘Bad Loans Bad Debts, Bad Blood. How Crypto Lender Cred Really Went Bankrupt.’ November 12, 2020. Retrieved from: https://finance.yahoo.com/news/bad-loans-bad-bets-bad-174516924.html