Bitcoin has been the tide lifting all cryptocurrency boats, inching ever closer to the long-awaited wide-scale adoption and making it increasingly difficult to ignore this burgeoning market. Critics can still be found, however, arguing that bitcoin and its cohorts are nothing more than speculative assets, mere bubbles that are destined to pop. Thanks to nods from the likes of PayPal, Tesla and Square, not to mention traditional Wall Street banks, bitcoin has finally proved its mettle to the world while the pioneers are enjoying their “I told you so” moment.

And while bitcoin has been the star of the show, it is not the only game in town. Other cryptocurrencies have been taking the spotlight in their own right. Ethereum has more than quadrupled its value year-to-date. Dogecoin, a once little known coin that started out as a joke, has become a household name and managed to muscle its way into the top four cryptocurrencies with a market cap that hovers at where bitcoin’s stood just a few short months ago.

Meanwhile, if you’re a betting person, XRP could be presenting a buying opportunity given that its price has been worn down by Ripple’s fight with the U.S. Securities and Exchange Commission (SEC). The options are endless, based on your personal risk/reward profile and time horizon as an investor.

Nobody could have predicted the course that the cryptocurrency market would take, not even Satoshi Nakamoto himself. But now that it is apparent this asset class isn’t going anywhere, investors have one question: What is the best cryptocurrency to invest in? We have done some digging and come up with a list of four cryptocurrencies — including the pros and cons of each —in an attempt to make the decision-making process a little easier for you.

Dogecoin – The Elephant in the Room

While bitcoin is the flagship cryptocurrency, and therefore would generally take up the No. 1 spot, Dogecoin has been the talk of the town, so we’ll start there. Thanks to the endorsement of high-profile entrepreneurs including Tesla and SpaceX chief Elon Musk as well as Dallas Mavericks owner Mark Cuban, this meme-fueled project — whose mascot Doge is a Japanese dog breed Shiba Inu — has taken on a life of its own.

When it comes to DOGE, investors are divided. Either the coin will literally go to the moon, thanks largely to Musk, or it is nothing more than a bubble that will prove to be a huge disappointment once it bursts. There are some market participants who are taking the middle ground, suggesting that DOGE will evolve into something more like a stable coin once it reaches a certain point.

All of the above are possibilities, and considering it is a fool’s game to take out the crystal ball to predict how the Dogecoin story will turn out, we are going to weigh the good and the bad.

Pros

- Confidence. Billionaire Elon Musk is Dogecoin’s biggest fan, which has had a bandwagon effect on the cryptocurrency. He touted DOGE on Saturday Night Live, revealing he would be buying some for his mom for Mother’s Day. With Dogecoin now getting mainstream exposure, it is drawing people into the cryptocurrency market who might not have otherwise taken the plunge.

- Use Cases. Dogecoin’s use cases are on the rise, thanks to its popularity, which appears to be a virtuous cycle for the project. SpaceX, of which Elon Musk is at the helm, has most recently announced that it will accept DOGE as a payment method for its DOGE-1 lunar mission planned for 2022. In addition, Mark Cuban has made it so that fans can use Dogecoin for the NBA’s Dallas Mavericks’ tickets and merchandise. The stronger that the use case argument for Dogecoin becomes, the more justification there is to the rising price.

- Short-Term Gains. DOGE investors have been raking in the profits, with the coin up an eye-popping 12,000 % year-to-date, a post-Elon/Saturday Night Live selloff notwithstanding. While it is difficult to say if those gains are sustainable, the sentiment surrounding DOGE remains largely excitable, which suggests that there could be more room to run for this emerging asset. Dogecoin has certainly been the best crypto to invest in so far in 2021, based on returns.

Source: Twitter

Source: Twitter

Cons

- Risk. Not all cryptocurrency influencers are on the Dogecoin bandwagon. Dogecoin Barry Silbert warned in a tweet that his company, DCG, is short DOGE. He expects that DOGE holders are going to ultimately convert their holdings into BTC. Meanwhile, Bitcoin bull Anthony Pompliano declared on Twitter that he owns zero Dogecoin. Renowned crypto analyst Mati Greenspan is not a fan of DOGE either, tweeting that it “makes a mockery of the entire financial system, not just bitcoin.” The DOGE price has fallen some 40% since its recent high and some traders expect it has further to fall.

- Inflation. As part of its design, when Dogecoin was created, it was made to have an unlimited supply. The co-founders did this to encourage users to use DOGE for things like tipping and to discourage them from “hodling,” considering this coin was designed as a joke to start. Bitcoin, meanwhile, is no joke and has a finite supply of 21 million coins. This makes Dogecoin vulnerable to inflation as more coins are issued into circulation. The supply/demand dynamic of a coin is a driver of fair value. As a result, in order for DOGE to maintain its gains, demand will need to continue to outpace the unlimited supply. Miners are currently earning block rewards of 10,000 DOGE per block, which is incentivizing them to join the network.

- Worthless. Dogecoin co-founders Billy Markus and Jackson Palmer have cashed out of the project and no longer have any skin in the game, with the exception of tips that Markus accepts in DOGE. Markus said that the “community started to strongly shift from one that I was comfortable with.” He went on to say, “Pump and dumping, rampant greed, scamming, bad-faith actors, demanding from others, hype without research, taking advantage of others — those are all worthless,” in reference to the Dogecoin community.

Bitcoin

It’s hard to bet against bitcoin, the one that started it all. As the first and biggest cryptocurrency and a dominance rate of 44.7% at last check, bitcoin’s fate appears to be all but sealed in the new financial paradigm. That doesn’t mean, however, that it’s the best crypto to invest in.

Source: Twitter

Source: Twitter

Pros

- Stalwart. Bitcoin has been around the longest of all the cryptocurrencies, and it has withstood the test of time in its 12-year history. With a market cap of approximately USD 1 trillion, it remains the largest cryptocurrency, one whose influence in the financial sphere is only increasing. Financial institutions like JPMorgan that one shunned bitcoin are now exploring giving their customers a way to gain exposure to the flagship cryptocurrency.

- Digital Gold. Bitcoin has earned the nickname as digital gold and therefore has become a rival store-of-value to the precious metal. Millennials are said to be flocking to bitcoin over gold, and this theory has been played out in the price of both assets year-to-date: gold is down 6% while bitcoin has gained 100% in the same period.

- Profits. If you had poured USD 1,000 in BTC a decade ago, you would be a crypto millionaire today. The Motley Fool points out that bitcoin was trading at USD 3.50 back then. So by investing USD 1,000, you’d have roughly 286 bitcoins. Fast forward to 2021 when the BTC price is trading near USD 55K, and your USD 1K turns into USD 15.6 million.

Cons

- Investor Psychology. Bitcoin is viewed to be pricey by newcomers. With bitcoin trading upwards of USD 55,000, it can be intimidating to the average investor. Despite the fact that you don’t have to buy 1 BTC and can buy what are known as satoshis, or the smallest fraction of a BTC, this investor psychology appears to be a limiting factor. Galaxy Digital CEO Mike Novogratz pointed it out, suggesting that cryptocurrency exchanges should start quoting the BTC price in satoshis to remove a barrier to entry for investors. Jesse Powell, chief executive of crypto exchange Kraken, said doing so could confuse newcomers even more.

- Bull Run. Historically, bitcoin’s bull runs don’t last forever. Bitcoin has been in a bull cycle all year and has set a new all-time high of USD 63,729 in April. That was not the first record of the year, demonstrating just how much the bulls have been in control. Another way to look at it is that the bitcoin price more than doubled in 2021, recent profit taking notwithstanding. If history is any indication, eventually the BTC price will peak, in response to which there will likely be a period of consolidation. The last thing you want to do is get buy at the peak. There are different theories out there for when that could happen, one of which is based on the timing of Bitcoin’s latest halving event. That outlook suggests that the bitcoin price is likely to reach a top in October 2021.

- Regulation. Blockchain startups are still operating in a murky regulatory environment, and policymakers continue to take shots at bitcoin. The Bank of England Governor Andrew Bailey recently warned that cryptocurrencies “have no intrinsic value,” saying, “Buy them only if you’re prepared to lose all your money.”

Ethereum

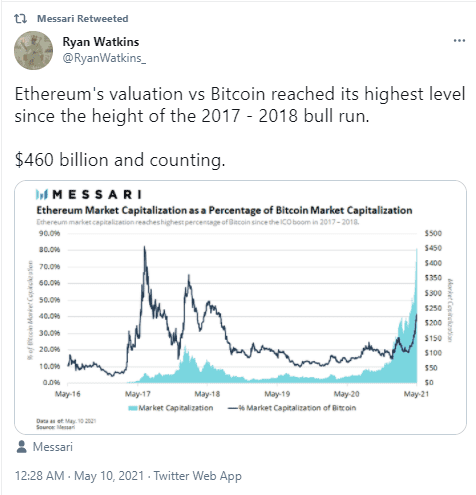

Ethereum (ETH) is the second-biggest cryptocurrency to invest in based on market cap and the crypto community either loves it or hates it. Those who love it are no doubt those who have been raking in the profits since ETH has returned approximately 400% YTD. Messari’s Ryan Watkins pointed out that Ethereum’s valuation compared to bitcoin’s is on the rise, attaining its “highest level since the height of the 2017-2018 bull run” at “USD 460 billion and counting.”

Source: Twitter

Source: Twitter

Pros

- Use Cases. Investing in Ethereum has a way of starting crazes. Think ICOs. CryptoKitties. More recently, Ethereum has become the go-to blockchain for decentralized finance (DeFi) applications, of which there is a total value locked of USD 51 billion on Ethereum currently. In addition, most non-fungible tokens, which are yet another craze in the crypto market, are built on, you guessed it, the Ethereum blockchain. There is also the fact that governments around the world are considering Ethereum to potentially build central bank digital currencies (CBDCs). We said it before, the stronger the use case for a cryptocurrency, the greater the price potential for that coin. This could help you decide if Ethereum is the best crypto to invest in.

- Profit Potential. The bull case for Ethereum is evident. Ethereum co-founder Vitalik Buterin was crowned the latest crypto billionaire as a result of the cryptocurrency’s recent all-time high of USD 3,500. Even though the ETH price has already increased more than fourfold in 2021 alone, Josh Wolfe, co-founder of Lux Capital, argues that it has the potential to rise 20x from its current level.

- ETH 2.0. The Ethereum network is in the midst of a multi-phase upgrade in which it is moving from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS), the latter of which is designed to bolster scalability and transaction times on the network. In addition, Ethereum developers are currently working on a fix for the high gas fees that users are experiencing when transacting on the blockchain.

Cons

- Lack of Scalability. Ethereum is currently limited by a lack of scalability that is blamed for slowing down transaction times and leading to excessive gas fees on the network. This is interfering with the growth of the network including in the NFT space, where in some cases people are willing to hop to another blockchain or abandon NFTs altogether due to unreasonable fees.

- Peak Ethereum? Ethereum is already trading at a new ATH, and it’s unclear how much more of a runway for gains is available to ETH investors. Cryptocurrencies are volatile assets, and ETH is no exception. For those who remember, after rising to nearly USD 1,400 in 2018, it was only a matter of weeks before it was trading below USD 400 with further to fall before it eventually stabilized.

XRP

XRP used to rank among the top-three cryptocurrencies but has since fallen from grace to the No. 7 coins based on the XRP market cap. Blockchain startup Ripple, which holds the majority of the XRP, is being sued by the U.S. SEC over the classification of XRP as an alleged unregistered security. In the interim, the value of the coin has been on a roller-coaster ride and Ripple’s role in the industry has become muddled, which could present a buying opportunity if you believe in the company’s chances and are not risk-averse.

Source: TradingView

Source: TradingView

Pros

- Use Cases: XRP has no shortage of use cases. The cryptocurrency powers cross-border startup Ripple’s products, including xRapid. It makes cross-border payments to retail and institutional customers faster and cheaper. In a nutshell, XRP’s use cases as per Stedas.HR includes: sourcing global liquidity, smart contracts, micropayments, real-time cross-border settlements, securities/FX settlements, business-to-business payments, bridge currency, store of value, and as a medium of exchange.

- Possible Opportunity. Depending on your risk-reward profile, XRP could be the best crypto to invest in. Unlike the aforementioned cryptocurrencies, the XRP price has a cloud hanging over it due to the uncertainty from the SEC case. If the company wins, it bodes well for XRP. But if it loses and becomes a scapegoat for the SEC, then investors could be left holding the bag.

- Strong Sales. What lawsuit? Ripple is keeping its nose to the grindstone despite the legal noise that has been surrounding the startup since year-end 2020. It recently reported a near doubling of its sales in Q1 2021 to USD 150 million vs. USD 76 million in Q4 2020. Ripple said the catalyst was an increase in its On-Demand Liquidity offering.

Cons

- SEC Lawsuit. As alluded to, Ripple and two key executives — CEO Brad Garlinghouse and chairman Chris Larsen — are being sued by the SEC for raising more than USD 1.3 billion in what the securities watchdog alleges were unregistered digital asset securities, not commodities. Ripple maintains that XRP is a currency, and the fight is ongoing.

- Supply. Ripple sells part of its XRP supply each quarter. The company has sold more than USD 1.1 billion of XRP in the last half-decade, which has become a point of controversy in the community.

Conclusion

So there you have it. The best crypto to invest in depends largely on your own risk/reward profile. Considering that market participants agree crypto remains in the early innings, chances are good that you will be able to score your own home run.

Source: Twitter

Source: Twitter

Litecoin is another peer-to-peer cryptocurrency and more customers are opting to buy litecoin with debit card or credit card. The Paybis platform was developed to help you buy and sell your favorite cryptocurrencies using a variety of payment methods.

Whether or not you will become the next crypto billionaire like Vitalik, however, is another question. Just keep in mind that when it comes to investing, there is no sure thing and be sure to do your own research.

Author Bio

Gerelyn Terzo is a cryptocurrency and blockchain journalist who has been engaged in the space since about mid-2017, when she first heard about bitcoin. Since then, she has never looked back and has contributed to crypto sites including Coinscrum, Invezz, Crypto Briefing, BeInCrypto, Cryptonews.com and more. Prior to cryptocurrencies, Gerelyn reported for major Wall Street trade publications on institutional investing. Ironically these two worlds have most recently converged.