Knowing when you should retire is one of the biggest decisions you will ever make. Once a person retires and leaves a job, it’s usually not that easy to go right back to the old job if retirement isn’t working out as planned.

Unfortunately, most people in the United States wait until they are in their late 50s or longer to start thinking about when or even if they can retire at all. This kind of procrastination can get people into a lot of trouble later on in life.

When starting your analysis as to when you can retire comfortably, you need to run a lot of calculations that take into account how much you have saved, your age at retirement, Social Security benefits, pension payments, expenses, life expectancy, and a whole host of other factors.

When starting your analysis as to when you can retire comfortably, you need to run a lot of calculations that take into account how much you have saved, your age at retirement, Social Security benefits, pension payments, expenses, life expectancy, and a whole host of other factors.

Retiring Early

Surprisingly, there are a lot of people who retire in their early 50s. Some of these people might work part time, but for the most part they have flexible jobs and/or work from home. A lot of these people who retire early might also live on very low expenses, have saved like crazy when they were younger, or sold a business for enough money to retire early.

Other strategies for those who retired early in life are moving overseas to a country with a very low cost of living, moving to a lower cost U.S. city, or selling a house and moving into a much less costly apartment. These ideas are not for everybody, but for some people it allows them to retire earlier than they otherwise could have.

Claim up to $26,000 per W2 Employee

- Billions of dollars in funding available

- Funds are available to U.S. Businesses NOW

- This is not a loan. These tax credits do not need to be repaid

There can be downsides to retiring early as well. Many people find that they quickly get bored and wish they had more to occupy their time. This is why a part-time job in retirement can be such a good idea. It’s important to be prepared with hobbies and things to keep you busy if you plan on not working much for the next 25 to 35 years.

One large potential issue with retiring early is how to pay for health care. The age when Medicare begins is 65, so if one retires at age 50, that is 15 years where health insurance costs are out of pocket. For a single person, health care costs at this age can range from $3,000 to $7,000 a year on average. For a couple, this can be doubled. This is one major expense that many people do not properly plan for if they retire early.

Another problem with retiring in your early 50s is the rules surrounding withdrawals of funds from a retirement account. You cannot withdraw money from an IRA or 401(k) plan until age 59 ½ without a 10% penalty and being hit with income taxes on the entire withdrawal amount. So those who retire before age 59 ½ must have enough money in taxable accounts to cover their expenses until they can access their retirement funds without a penalty.

Figuring Out When You Can Retire

There are obviously a lot of factors to consider when deciding if you should retire early. Many people use free retirement calculators to figure out if they can retire in their early 50s, but this is a mistake. The vast majority of free retirement calculators are notoriously inaccurate. They don’t take into account the complex federal tax code, Required Minimum Distributions (RMDs) from retirement accounts, different investment account types such as Roth IRAs, 529 plans, deferred compensation accounts, and many more. Just getting taxes wrong can skew the results by thousands of dollars and can lead to bad decision making.

We use a financial and retirement planning application called WealthTrace to figure out when a person or a couple can retire comfortably. Unlike so many of the free calculators that exist, WealthTrace takes into account nearly every investment type that exists as well as our complex federal tax code. We like to run what-if scenarios on items such as spending, inflation, rates of return, and retirement age to get a sense for how fragile a retirement plan might be. Running what-if scenarios on many variables can also give people confidence that their retirement situation is on good footing.

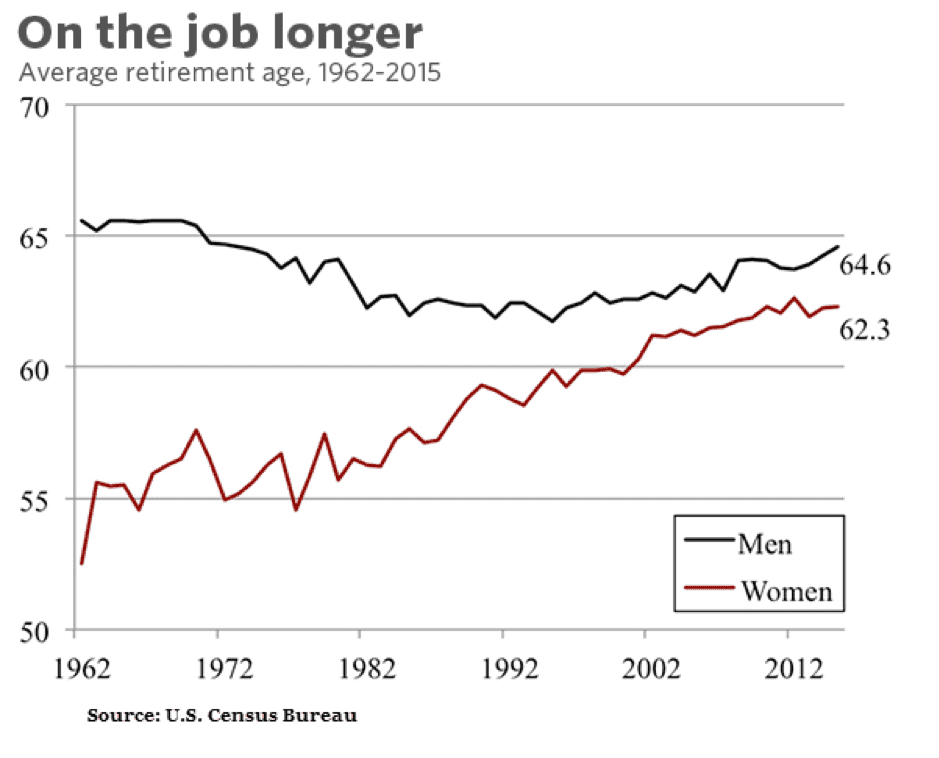

Retiring In Your Early 60s

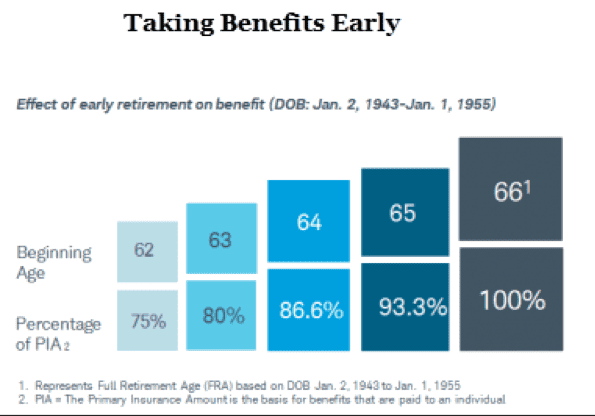

The current average age of retirement in the U.S. is 62. So if you retire in your early 60s, you’re right there with a lot of other people. One reason many people wait until age 62 to retire is that this is the earliest age when one can start receiving Social Security benefits. But taking Social Security early can be a mistake for many people since you lose nearly 7% of you benefits for every year you take Social Security early, with the maximum reduction being 30%. For example, if your Social Security benefits are projected to be $30,000 at your Full Retirement Age of 67, if you take the benefits at 62 they would only be $21,000 per year for life. This means the break-even age where this no longer makes sense is age 74. If you live past age 74 then in terms of cumulative amount from Social Security, you would have been better off waiting until age 67 to start taking benefits.

Retiring In Your 70s

Some people retire in their early 70s because they simply love their jobs or simply cannot imagine not working. Other people wait until 70 to quit working so they can receive the maximum Social Security benefit. For each year one waits beyond their Full Retirement Age, he or she will receive an extra 8% in Social Security benefits. For example, if your projected Social Security benefit is $30,000 per year at age 67, if you wait until age 70 it would be $30,000 * (1 + (3 * 8%)) = $37,200 per year.

We All Have Different Retirement Goals

There are millions of different retirement goals out there. To figure out if your particular retirement situation and plan make sense, you have to start planning early. Don’t procrastinate. Use accurate and detailed retirement planning software to get your arms around your situation so you can retire stress-free.